Pressure on EUR/USD below 1.0950, ECB speech in focus.

FUNDAMENTAL OVERVIEW

On Monday, the EUR/USD is trading below 1.0950 while being defensive. The resurgence of the US Dollar and risk aversion are weighing on the pair as investors take in US-Sino developments amid growing concerns about Chinese growth. The language will be ECB-speak. Juneteenth falls on a holiday in the US.

The EUR/USD pair is trading close to the 1.0900 level at the start of the week, dropping from the 1.0970 multi-week high set last Friday. Softer-than-expected US inflation-related data and the Federal Reserve’s (Fed) hawkish pause led to a sell-off spiral in the US Dollar. In response to expectations that the US will avoid a recession, financial markets became upbeat. While the safe-haven dollar dropped off investors’ radar, stocks rose.

The European Central Bank (ECB) increased its benchmark interest rates at the same time, foreseeing future increases. The news did not come as a surprise, but it supported the Euro’s ascent.

A further increase in interest rates looks fair for July, according to ECB Member of the Executive Board Philip R. Lane, while the decision for September will be based on data. When he predicted that inflation would swiftly drop to the central bank’s 2% objective, he sounded optimistic. While this was going on, Isabel Schnabel, a different ECB Executive Board member, raised alarm over the central bank’s underestimation of inflation and said the interest rate path should have been sharper.

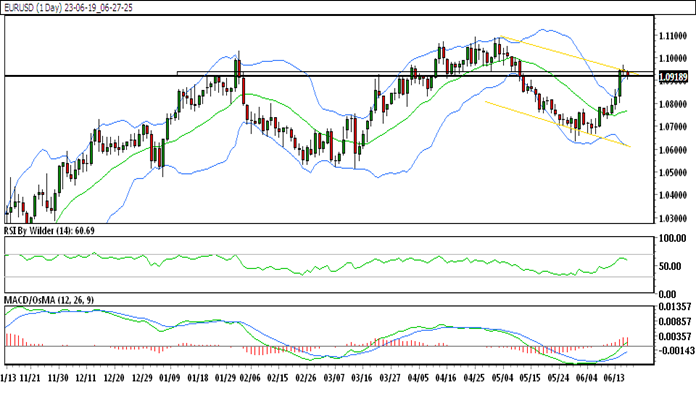

EUR/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

EUR/USD is trading in the down channel.

EUR/USD currently trading above all SMA.

RSI is in buying zone which suggests bullishness and Stochastic is suggesting up trend.

EUR/USD resistance is at 1.09521 & its immediate support level is 1.09232

HOW TO TRADE EUR/USD

Following a decline, the EUR/USD price began to rise, but it was unable to hold. When the EUR/USD faced resistance, the price turned downward. The price is currently at a crucial support level; if this level is broken, further fall is possible.