The foreign exchange market remains highly volatile as major currency pairs respond to shifting economic data and trade policy uncertainties. The EUR/USD continues its decline amid weak European business sentiment, while GBP/USD holds firm, supported by strong UK PMI figures. Meanwhile, NZD/USD and USD/CAD fluctuate ahead of potential tariff announcements from U.S. President Donald Trump. This article provides a detailed breakdown of market trends, technical analysis, and key trading opportunities.

KEY HIGHLIGHTS

- EUR/USD Extends Decline Amid Weak European Business Sentiment.

- GBP/USD Holds Firm as UK PMI Data Strengthens.

- NZD/USD Falls as Trump’s Tariff Strategy Creates Uncertainty.

- USD/CAD Rises Amid Caution Over Trump’s Tariff Plans.

EUR/USD: Extends Decline Amid Weak European Business Sentiment

Market Overview

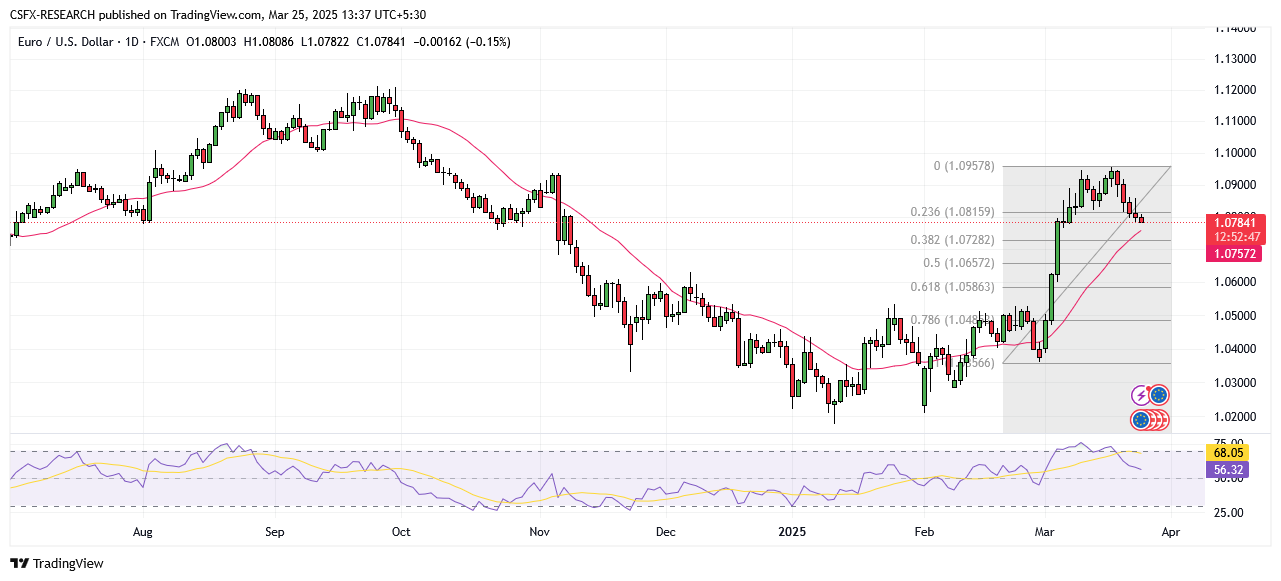

The EUR/USD experienced turbulence on Monday, dipping below the 1.0800 level as traders navigated mixed economic data and lingering tariff concerns. Despite hopes for potential tariff exemptions hinted at by U.S. President Donald Trump, weak Purchasing Managers Index (PMI) survey data continued to weigh on the currency pair.

The U.S. Manufacturing PMI for March fell to a three-month low of 49.8, signaling contraction, while the Services PMI surged to 54.3, reflecting resilience in the services sector. Investors are now eyeing the upcoming U.S. Personal Consumption Expenditure (PCE) Price Index data, scheduled for release on Friday, for further direction.

Technical Analysis

Moving Averages

- Exponential:

- MA 10: 1.0823 | Negative Crossover | Bearish

- MA 20: 1.0761 | Positive Crossover | Bullish

- MA 50: 1.0628 | Positive Crossover | Bullish

- Simple:

- MA 10: 1.0863 | Negative Crossover | Bearish

- MA 20: 1.0757 | Positive Crossover | Bullish

- MA 50: 1.0547 | Positive Crossover | Bullish

Indicators

- RSI (Relative Strength Index): 56.26 | Neutral

- Stochastic Oscillator: 45.00 | Neutral

Key Levels

- Resistance: R1: 1.0493, R2: 1.0568

- Support: S1: 1.0249, S2: 1.0174

Trade Suggestion

- Limit Buy: 1.0682 | Take Profit: 1.0852 | Stop Loss: 1.0585

GBP/USD: Holds Steady Above 1.2900 Amid USD Retreat

Market Overview

The GBP/USD remains resilient, trading around 1.2920 during Tuesday’s Asian session. Despite recent gains in the U.S. Dollar, the Pound found support from robust UK PMI data, reflecting economic recovery.

The S&P Global Services PMI surged to 54.3, marking a three-month high, while the Composite PMI climbed to 53.5, reflecting strong economic expansion. Market expectations for a Bank of England (BoE) rate cut in May have eased, with the probability of a 25-basis-point reduction dropping to 60%.

Technical Analysis

Moving Averages

- Exponential:

- MA 10: 1.2925 | Negative Crossover | Bearish

- MA 20: 1.2863 | Positive Crossover | Bullish

- MA 50: 1.2726 | Positive Crossover | Bullish

- Simple:

- MA 10: 1.2954 | Negative Crossover | Bearish

- MA 20: 1.2869 | Positive Crossover | Bullish

- MA 50: 1.2622 | Positive Crossover | Bullish

Indicators

- RSI: 59.36 | Bullish

- Stochastic Oscillator: 53.17 | Neutral

Key Levels

- Resistance: R1: 1.2691, R2: 1.2801

- Support: S1: 1.2335, S2: 1.2225

Trade Suggestion

- Limit Buy: 1.2779 | Take Profit: 1.3011 | Stop Loss: 1.2655

NZD/USD: Declines Below 0.5750 Amid US Tariff Concerns

Market Overview

The NZD/USD extended its decline to 0.5725 as the market awaited U.S. tariff decisions. Despite strong New Zealand GDP data, expectations of a Reserve Bank of New Zealand (RBNZ) rate cut remain high, with economists predicting two 25bp cuts in April and May.

Technical Analysis

Moving Averages

- Exponential:

- MA 10: 0.5739 | Negative Crossover | Bearish

- MA 20: 0.5727 | Negative Crossover | Bearish

- MA 50: 0.5714 | Negative Crossover | Bearish

Indicators

- RSI: 48.47 | Neutral

- Stochastic Oscillator: 40.48 | Neutral

Key Levels

- Resistance: R1: 0.5726, R2: 0.5787

- Support: S1: 0.5531, S2: 0.5471

Trade Suggestion

- Limit Sell: 0.5737 | Take Profit: 0.5678 | Stop Loss: 0.5775

USD/CAD: Rises Above 1.4300 With Upside Potential

Market Overview

The USD/CAD hovers around 1.4330, supported by uncertainty over U.S. tariff announcements. While the Canadian Dollar found some support on hopes of tariff exemptions, hawkish Fed remarks and strong U.S. PMI data keep the U.S. Dollar elevated.

Technical Analysis

Moving Averages

- Exponential:

- MA 10: 1.4337 | Negative Crossover | Bearish

- MA 20: 1.4341 | Negative Crossover | Bearish

- MA 50: 1.4320 | Positive Crossover | Bullish

Indicators

- RSI: 49.15 | Neutral

- Stochastic Oscillator: 32.01 | Neutral

Key Levels

- Resistance: R1: 1.4715, R2: 1.4866

- Support: S1: 1.4224, S2: 1.4073

Trade Suggestion

- Limit Sell: 1.4344 | Take Profit: 1.4289 | Stop Loss: 1.4373

Forex Market Summary

- AUD/USD: Down 0.04% to 0.6282

- USD/JPY: Down 0.05% to 150.63

- EUR/GBP: Down 0.07% to 0.8351

- USD/CNY: Up 0.13% to 7.2622

Key Economic Events Today

- (USD) CB Consumer Confidence (Mar): Forecast 94.2, Previous 98.3

- (USD) New Home Sales (Feb): Forecast 682K, Previous 657K