The foreign exchange market remains cautious as traders anticipate the US Personal Consumption Expenditures (PCE) Price Index. Major currency pairs are reacting to economic data and trade developments, with EUR/USD struggling below 1.0800, GBP/USD remaining subdued, JPY extending its recovery, and AUD weakening amid risk aversion. Investors await key inflation data for further market direction.

KEY HIGHLIGHTS

- EUR/USD Remains Subdued as Markets Await US PCE Data.

- GBP/USD Holds Steady Amid Uncertainty Over Trump’s Tariffs.

- JPY Extends Recovery as BoJ Hawkishness Supports Bullish Sentiment.

- AUD/USD Weakens on Risk Aversion, Awaiting PCE Release.

Markets in Focus Today – EUR/USD

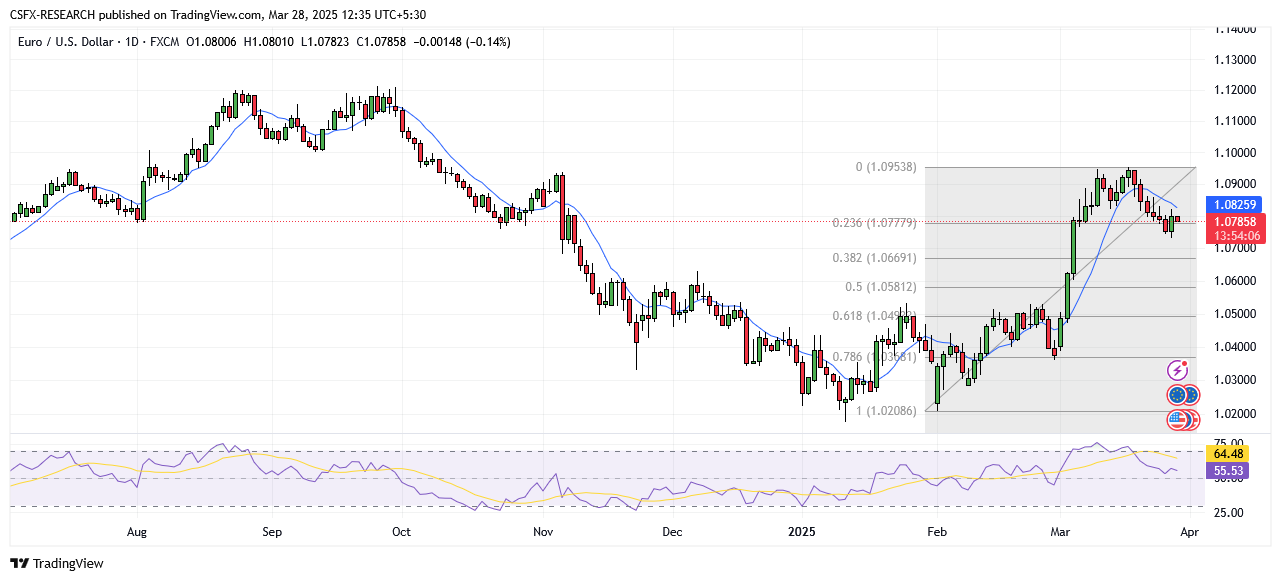

EUR/USD Edges Lower Ahead of US PCE Price Index

EUR/USD maintains a bearish tone, trading below 1.0800, as traders closely monitor the US PCE Price Index for insights into the Federal Reserve’s monetary policy.

The EUR/USD pair struggles to sustain momentum after rebounding from a three-week low near 1.0780. Spot prices remain under mild bearish pressure below 1.0800, with market participants waiting for the US inflation data to gauge the Fed’s next policy moves. The US Dollar stabilizes after retreating from a multi-week high, creating headwinds for the euro.

Further downside pressure on EUR/USD arises from escalating US-EU trade tensions. President Donald Trump’s announcement of a 25% tariff on imported cars has led to concerns of EU retaliation, weighing on the euro’s strength against the Greenback.

Technical Analysis

- Exponential Moving Averages (EMA):

- MA 10: 1.0803 | Negative Crossover | Bearish

- MA 20: 1.0765 | Positive Crossover | Bullish

- MA 50: 1.0645 | Positive Crossover | Bullish

- Relative Strength Index (RSI): 55.44 | Buy Zone | Bullish

- Stochastic Oscillator: 17.48 | Sell Zone | Neutral

- Resistance & Support Levels:

- R1: 1.0493 | R2: 1.0568

- S1: 1.0249 | S2: 1.0174

Trade Suggestion: Limit Buy: 1.0706 | Take Profit: 1.0859 | Stop Loss: 1.0623

GBP/USD Stays Steady Amid UK Economic Data

GBP/USD remains stable around 1.2950 following the UK’s economic data release.

Despite upbeat UK Retail Sales figures for February, GBP/USD struggles for a clear directional bias as Trump’s tariff plans dampen risk sentiment. Earlier in the week, weaker-than-expected UK inflation data and a downgraded 2025 GDP growth forecast from the Office for Budget Responsibility weighed on the British Pound. Market focus now shifts to the US Core PCE Price Index, expected to influence USD price movements.

Technical Analysis

- Exponential Moving Averages (EMA):

- MA 10: 1.2931 | Positive Crossover | Bullish

- MA 20: 1.2882 | Positive Crossover | Bullish

- MA 50: 1.2750 | Positive Crossover | Bullish

- Relative Strength Index (RSI): 60.69 | Buy Zone | Bullish

- Stochastic Oscillator: 39.43 | Sell Zone | Neutral

- Resistance & Support Levels:

- R1: 1.2691 | R2: 1.2801

- S1: 1.2335 | S2: 1.2225

Trade Suggestion: Limit Buy: 1.2811 | Take Profit: 1.3048 | Stop Loss: 1.2691

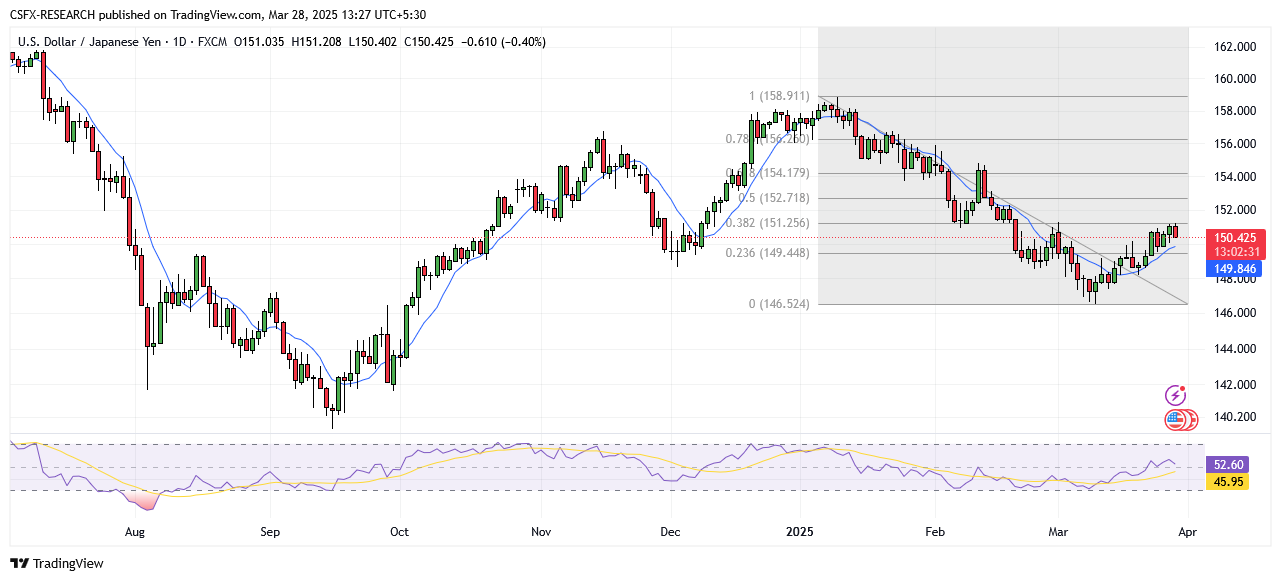

USD/JPY Gains as Risk Sentiment Supports the Yen

The Japanese Yen extends its recovery from a multi-week low against the US Dollar. Strong Tokyo inflation data and expectations of a more hawkish Bank of Japan (BoJ) continue to support the Yen.

Market participants anticipate that the BoJ will maintain a tightening stance, while the Federal Reserve is expected to resume its rate-cut cycle. This contrast between central bank policies supports the JPY. However, USD/JPY remains volatile ahead of the US PCE Price Index release.

Technical Analysis

- Exponential Moving Averages (EMA):

- MA 10: 149.90 | Positive Crossover | Bullish

- MA 20: 149.75 | Positive Crossover | Bullish

- MA 50: 150.88 | Negative Crossover | Bearish

- Relative Strength Index (RSI): 52.82 | Neutral Zone | Neutral

- Stochastic Oscillator: 90.17 | Neutral Zone | Neutral

- Resistance & Support Levels:

- R1: 154.47 | R2: 156.20

- S1: 148.88 | S2: 147.15

Trade Suggestion: Limit Sell: 150.67 | Take Profit: 149.95 | Stop Loss: 151.11

AUD/USD Weakens as US Dollar Strengthens

The Australian Dollar (AUD) declines as market sentiment remains cautious ahead of the US PCE Price Index release.

AUD/USD slides amid risk aversion, driven by concerns over Trump’s 25% auto tariff. A Reuters poll suggests that the Reserve Bank of Australia (RBA) will keep rates steady at 4.10% in April, with two rate cuts expected in 2025. However, a May rate cut depends on Q1 inflation data, with 75% of economists expecting a reduction. Despite persistent inflation, Australia’s economic outlook remains uncertain.

Technical Analysis

- Exponential Moving Averages (EMA):

- MA 10: 0.6301 | Negative Crossover | Bearish

- MA 20: 0.6303 | Negative Crossover | Bearish

- MA 50: 0.6305 | Negative Crossover | Bearish

- Relative Strength Index (RSI): 48.56 | Neutral Zone | Neutral

- Stochastic Oscillator: 27.28 | Sell Zone | Neutral

- Resistance & Support Levels:

- R1: 0.6356 | R2: 0.6431

- S1: 0.6111 | S2: 0.6035

Trade Suggestion: Limit Sell: 0.6320 | Take Profit: 0.6258 | Stop Loss: 0.6358

Elsewhere in the Forex Market

- USD/CAD up 0.14% to 1.4328

- NZD/USD down 0.29% to 0.5724

- EUR/GBP down 0.11% to 0.8331

- EUR/AUD up 0.03% to 1.7137

- AUD/NZD up 0.18% to 1.1004

- USD/CNY down 0.03% to 7.2620

- AUD/SEK down 0.01% to 6.3048

Key Economic Events & Data Releases Today

- (GBP) GDP (QoQ) (Q4): Forecast 0.1%, Previous 0.0% (12:30)

- (USD) Core PCE Price Index (MoM) (Feb): Forecast 0.3%, Previous 0.3% (18:00)

- (USD) Core PCE Price Index (YoY) (Feb): Forecast 2.7%, Previous 2.6% (18:00)

- (CAD) GDP (MoM) (Jan): Forecast 0.2%, Previous 0.2% (18:00)