The commodity market remains at the center of investor attention as gold, silver, crude oil, and natural gas react to key economic and geopolitical developments. Gold hovers near record highs ahead of the Federal Reserve decision, while silver sustains its bullish momentum. Meanwhile, WTI crude struggles amid potential increases in Russian supply, and natural gas tests critical support levels due to shifting market dynamics.

KEY HIGHLIGHTS

- Gold Near Record High as Fed Decision Looms.

- Silver Holds Bullish Momentum Near $34 Amid Optimism.

- WTI Crude Faces Pressure on Russian Supply Outlook.

- Natural Gas Tests Key Support as Prices Remain Under Pressure.

Gold (XAU/USD) Analysis

Gold Prices Steady Near Record Highs as Investors Await Fed Decision

Gold prices remain close to an all-time high of $3,045, as traders adopt a cautious stance ahead of the U.S. Federal Reserve’s policy announcement. The central bank is expected to maintain interest rates within the 4.25%-4.50% range, with markets closely monitoring Chair Jerome Powell’s commentary for hints on future monetary policy.

A slight rebound in the U.S. Dollar has tempered gold’s recent gains, yet geopolitical tensions, including former U.S. President Donald Trump’s aggressive trade policies and Middle East conflicts, continue to drive safe-haven demand. However, overbought technical conditions could limit short-term bullish momentum.

Technical Overview

Moving Averages:

- Exponential: MA 10: 2976.45 | MA 20: 2942.32 | MA 50: 2865.39 (Bullish)

- Simple: MA 10: 2960.18 | MA 20: 2935.97 | MA 50: 2852.78 (Bullish)

Indicators:

- RSI: 72.76 (Bullish)

- Stochastic Oscillator: 97.08 (Neutral)

Resistance & Support Levels:

- Resistance: R1: 2932.05 | R2: 2975.46

- Support: S1: 2791.51 | S2: 2748.10

Trade Suggestion: Buy Limit: 3027.00 | Take Profit: 3045.50 | Stop Loss: 3018.20

Silver (XAG/USD) Analysis

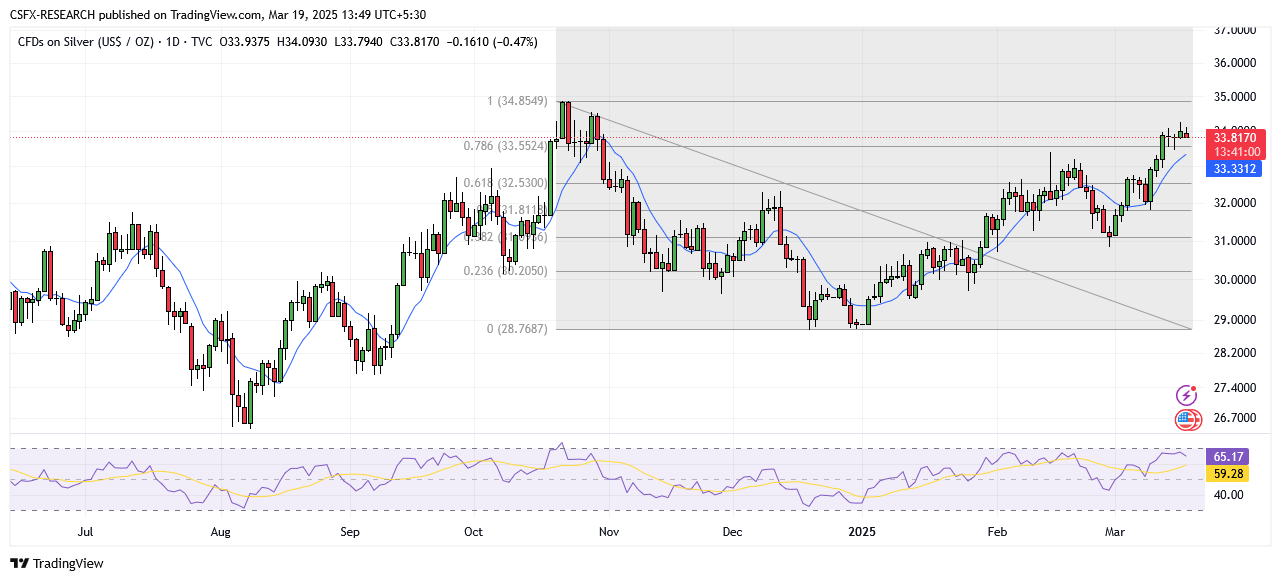

Silver Holds Strong Near Multi-Month Highs at $34.00

Silver continues its bullish momentum, trading around $34.00—its highest level since late October. If it breaks above $34.25, further upside towards $34.50 and potentially $35.00 is likely. However, a pullback below $33.40 could expose key support levels at $31.50 and $30.80.

Technical Overview

Moving Averages:

- Exponential: MA 10: 33.31 | MA 20: 32.82 | MA 50: 31.41 (Bullish)

- Simple: MA 10: 33.22 | MA 20: 32.58 | MA 50: 31.10 (Bullish)

Indicators:

- RSI: 66.47 (Bullish)

- Stochastic Oscillator: 97.27 (Neutral)

Resistance & Support Levels:

- Resistance: R1: 34.26 | R2: 34.79

- Support: S1: 33.35 | S2: 32.65

Trade Suggestion: Buy Limit: 33.34 | Take Profit: 34.24 | Stop Loss: 32.83

Crude Oil (WTI) Analysis

WTI Crude Faces Pressure as Markets Assess Russian Supply Outlook

WTI crude oil remains under pressure, trading near $66.50 per barrel, amid potential increases in Russian supply. Despite a temporary pause in attacks on energy infrastructure agreed upon by U.S. President Donald Trump and Russian President Vladimir Putin, the broader geopolitical tensions persist. Any signs of an extended ceasefire could ease sanctions on Russian oil exports, further pressuring prices.

Technical Overview

Moving Averages:

- Exponential: MA 10: 67.16 | MA 20: 68.10 | MA 50: 69.92 (Bearish)

- Simple: MA 10: 66.80 | MA 20: 68.12 | MA 50: 71.66 (Bearish)

Indicators:

- RSI: 39.45 (Bearish)

- Stochastic Oscillator: 31.74 (Neutral)

Resistance & Support Levels:

- Resistance: R1: 73.75 | R2: 75.35

- Support: S1: 68.54 | S2: 66.94

Trade Suggestion: Sell Limit: 67.22 | Take Profit: 65.69 | Stop Loss: 68.36

Natural Gas Analysis

Natural Gas Futures Struggle at Key Support Levels

Natural gas prices are testing critical support at $3.950. A decisive break below this level could accelerate losses toward $3.713, which has held since December. Mild weather conditions and rising U.S. natural gas production continue to weigh on prices, while traders closely monitor weather model updates for potential bullish catalysts.

Technical Overview

Moving Averages:

- Exponential: MA 10: 4.17 | MA 20: 4.15 | MA 50: 3.93 (Bearish)

- Simple: MA 10: 4.23 | MA 20: 4.22 | MA 50: 3.96 (Bearish)

Indicators:

- RSI: 56.00 (Neutral)

- Stochastic Oscillator: 20.69 (Neutral)

Resistance & Support Levels:

- Resistance: R1: 4.36 | R2: 4.62

- Support: S1: 3.52 | S2: 3.26

Trade Suggestion: Sell Limit: 4.03 | Take Profit: 3.92 | Stop Loss: 4.12

Elsewhere in the Commodity Market

- Gold: Down 0.06% at $3,032.43

- Silver: Down 0.55% at $33.80

- Palladium: Down 0.66% at $960.45

- Platinum: Down 1.7% at $985.87

- Brent Crude Oil: Down 0.06% at $70.36

- WTI Crude Oil: Up 0.01% at $66.69

Key Economic Events & Data Releases Today

- (JPY) BoJ Interest Rate Decision: Forecast 0.50%, Previous 0.50% (08:00)

- (EUR) Core CPI (YoY) (Feb): Forecast 2.4%, Previous 2.5% (15:30)

- (USD) FOMC Statement: (23:30)

- (USD) Fed Interest Rate Decision: (23:30)

Conclusion

Gold and silver maintain bullish momentum, while crude oil and natural gas face downside risks amid geopolitical uncertainties and supply concerns. As markets await key economic data and central bank decisions, traders should remain vigilant for potential price shifts across major commodities.