The forex market experiences notable shifts as major currency pairs react to economic data, central bank policies, and geopolitical developments. The U.S. Dollar weakens amid disappointing retail sales, fueling speculation of a potential Federal Reserve (Fed) rate cut. Meanwhile, the Euro, Pound, Yen, and Australian Dollar exhibit varying trends as investors assess economic indicators and monetary policy outlooks.

KEY HIGHLIGHTS

- EUR/USD Struggles Below 1.0500 Amid Liquidity and Tariff Delays

- GBP/USD Rises as Weak U.S. Retail Sales Weigh

- USD/JPY Drops as Strong Japanese GDP Supports Yen

- AUD/USD Gains Ahead of RBA Rate Decision Meeting

EUR/USD Struggles to Maintain Gains

EUR/USD consolidates near a multi-week high, struggling to break above the 1.0500 resistance level. The pair stabilizes around 1.0490 during Asian trading hours, with limited liquidity expected in the North American session due to the U.S. holiday. The recent rally was driven by delays in U.S. President Donald Trump’s reciprocal tariffs and weaker-than-expected U.S. economic data, which weighed on the U.S. Dollar (USD). A sharper-than-expected decline in U.S. retail sales further intensified speculation that the Fed may lower interest rates later this year.

Additionally, market speculation suggests that EUR/USD could appreciate by up to 5% if a ceasefire in Ukraine leads to resumed gas supplies. Reports indicate that U.S. and Russian officials may engage in peace negotiations, adding another layer of uncertainty to the forex market.

Technical Analysis

- Exponential Moving Averages (EMA):

- EMA 10: 1.0420 | Bullish

- EMA 20: 1.0401 | Bullish

- EMA 50: 1.0431 | Bullish

- Relative Strength Index (RSI): 60.66 | Buy Zone | Bullish

- Stochastic Oscillator: 87.76 | Neutral

- Key Resistance Levels: R1: 1.0492 | R2: 1.0576

- Key Support Levels: S1: 1.0220 | S2: 1.0136

- Market Direction: Bullish

- Trade Suggestion: Limit Buy: 1.0465 | Take Profit: 1.0534 | Stop Loss: 1.0427

GBP/USD Rises Amid Strong UK GDP Data

GBP/USD remains in positive territory, trading above 1.2550 after disappointing U.S. retail sales data weakened the Greenback. The pair edges higher near 1.2585 in the early Asian session, supported by strong UK Gross Domestic Product (GDP) growth. The UK economy expanded by 0.1% in Q4 2024, exceeding expectations and reinforcing investor confidence in the British Pound (GBP).

Traders will closely watch upcoming UK labor market and inflation data, as these reports may influence the Bank of England’s (BoE) interest rate decisions.

Technical Analysis

- Exponential Moving Averages (EMA):

- EMA 10: 1.2496 | Bullish

- EMA 20: 1.2460 | Bullish

- EMA 50: 1.2495 | Bullish

- Relative Strength Index (RSI): 61.80 | Buy Zone | Bullish

- Stochastic Oscillator: 92.59 | Neutral

- Key Resistance Levels: R1: 1.2538 | R2: 1.2650

- Key Support Levels: S1: 1.2174 | S2: 1.2062

- Market Direction: Neutral to Bullish

- Trade Suggestion: Limit Buy: 1.2534 | Take Profit: 1.2663 | Stop Loss: 1.2462

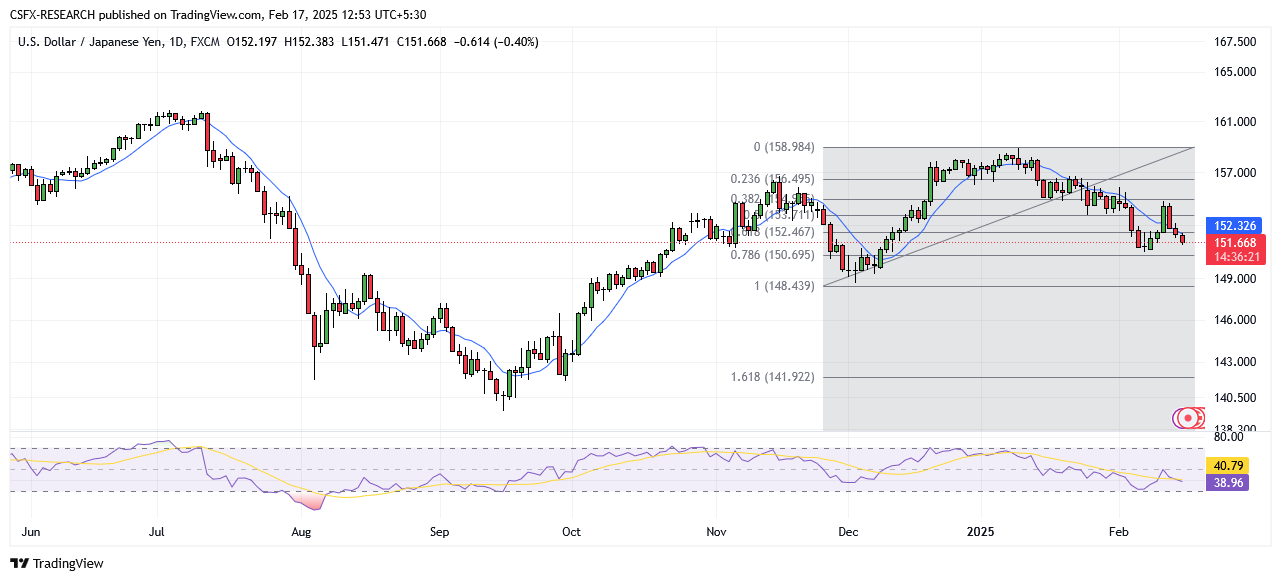

USD/JPY Drops as Japanese Yen Strengthens

The Japanese Yen (JPY) gains strength after an upbeat domestic GDP report, reinforcing expectations that the Bank of Japan (BoJ) may continue raising interest rates. The narrowing U.S.-Japan rate differential further supports JPY demand, pushing USD/JPY lower near the mid-151.00s.

Additionally, concerns over Trump’s proposed reciprocal tariffs add uncertainty to USD/JPY movements. However, the Fed’s hawkish stance may provide some support for the USD in the longer term.

Technical Analysis

- Exponential Moving Averages (EMA):

- EMA 10: 152.80 | Bearish

- EMA 20: 153.64 | Bearish

- EMA 50: 154.21 | Bearish

- Relative Strength Index (RSI): 38.56 | Sell Zone | Bearish

- Stochastic Oscillator: 24.99 | Neutral

- Key Resistance Levels: R1: 157.89 | R2: 159.11

- Key Support Levels: S1: 153.95 | S2: 152.73

- Market Direction: Bearish

- Trade Suggestion: Limit Sell: 152.19 | Take Profit: 150.89 | Stop Loss: 153.10

AUD/USD Gains Amid Risk-On Sentiment

The Australian Dollar (AUD) extends gains against the USD for a third consecutive session, supported by Trump’s decision to postpone reciprocal tariffs. Additionally, the weaker USD, driven by disappointing U.S. retail sales data, boosts AUD/USD sentiment. However, expectations of an imminent Reserve Bank of Australia (RBA) rate cut could limit further gains.

The RBA is expected to lower its Official Cash Rate (OCR) by 25 basis points to 4.10% on Tuesday, marking its first rate reduction in four years. Meanwhile, Australian inflation expectations rose to 4.6% in February, fueling speculation about future monetary policy adjustments.

Technical Analysis

- Exponential Moving Averages (EMA):

- EMA 10: 0.6304 | Bullish

- EMA 20: 0.6281 | Bullish

- EMA 50: 0.6303 | Bullish

- Relative Strength Index (RSI): 66.33 | Buy Zone | Bullish

- Stochastic Oscillator: 96.03 | Neutral

- Key Resistance Levels: R1: 0.6299 | R2: 0.6346

- Key Support Levels: S1: 0.6146 | S2: 0.6099

- Market Direction: Bullish

- Trade Suggestion: Limit Buy: 0.6339 | Take Profit: 0.6418 | Stop Loss: 0.6294

Elsewhere in the Forex Market

- USD/CHF up 0.07% to 0.9001

- NZD/USD up 0.13% to 0.5737

- EUR/GBP down 0.08% at 0.8329

- EUR/AUD down 0.23% at 1.6476

- AUD/NZD up 0.01% at 1.1098

- USD/CNY down 0.08% at 7.2470

- AUD/SEK up 0.34% at 6.8162

Key Economic Events Today

- JPY GDP (QoQ) (Q4): Forecast 1.0%, Previous 1.7% at 05:20 GMT

- Eurogroup Meetings: 15:30 GMT

Conclusion

As major currencies react to economic data, central bank policies, and geopolitical events, traders must stay updated on market trends. EUR/USD struggles at resistance, GBP/USD rises on strong UK GDP, USD/JPY declines on a stronger JPY, and AUD/USD gains amid risk-on sentiment. Keep an eye on upcoming economic releases for further market direction.