Analyst predicts a 15% downside risk for Nvidia stock as artificial intelligence reaches the ‘trough of disillusionment.’

FUNDAMENTAL OVERVIEW:

Analysts emphasize NVIDIA’s pivotal role in accelerated computing, projecting an impressive 20% compound annual growth rate (CAGR) from 2022 across cycles.

Despite acknowledging NVDA’s dominance, analysts express doubt regarding the consensus expectations for future years, anticipating a return to the trend line in the next 2-6 quarters.

They cite the vulnerability of NVDA as the hype around artificial intelligence (AI) approaches the “trough of disillusionment.” Initiating new research coverage, analysts rate Nvidia (NASDAQ: NVDA) stock as Neutral with a $410 per share price target, implying a 15% downside risk based on Tuesday’s closing price.

The target is derived from a 35x multiple on the $7.29 of CY24 EPS for the core company and $155 for the sandbox revenue expected in the next 4-6 quarters. Analysts believe the value of this sandbox could decline significantly once NVDA’s growth slows.

Nvidia stock closed 2.7% lower on the first trading day in 2024 and is down an additional 1.1% in pre-market trading on Wednesday.

NVIDIA TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

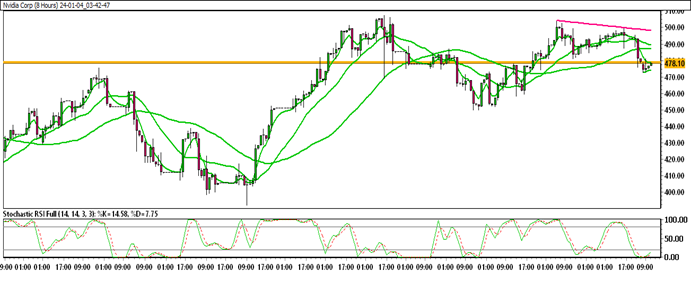

Nvidia is currently trading within an up channel.

Nvidia is positioned below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Selling zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 483.44

Immediate support level: 476.27

HOW TO TRADE NVIDIA

Following a significant price surge, Nvidia stock encountered resistance and has currently formed a double-top pattern in a smaller time frame. Presently, it is attempting to sustain its upward movement. If it fails to maintain this upward trend, Nvidia may experience a further decline toward a significant support zone.

TRADE SUGGESTION- STOP SELL– 472.69, TAKE PROFIT AT- 449.58, SL AT- 489.42.