Gold prices decline as the dollar strengthens in anticipation of the release of Fed minutes

FUNDAMENTAL OVERVIEW:

In Asian trading on Wednesday, gold prices declined, giving up a portion of recent gains as the dollar strengthened amid uncertainty regarding the timing of the Federal Reserve’s interest rate cuts in 2024.

In the last days of 2023, the price of gold experienced a significant increase, fuelled by optimism about the possibility of the Fed initiating rate cuts as early as March 2024. Despite spot gold trading within $100 of its record high in early December, markets sought further confirmation of an early 2024 rate reduction from the Fed. Consequently, gold relinquished some recent gains, and the dollar sharply rebounded from its nearly five-month lows on Tuesday.

Fed Minutes and nonfarm payrolls awaited more cues.

The markets remained tense in anticipation of the Federal Reserve’s December meeting minutes, scheduled for later in the day. Analysts cautioned that the minutes might not convey as dovish a sentiment as anticipated.

Although the Federal Reserve indicated intentions for rate cuts in 2024, Chair Jerome Powell offered limited hints regarding the timing or magnitude of these anticipated rate reductions.

Gold experienced a robust rally in December and might still possess additional upward momentum. The prospect of lower interest rates is favorable for the precious metal, as higher yields increase the opportunity cost of investing in gold.

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

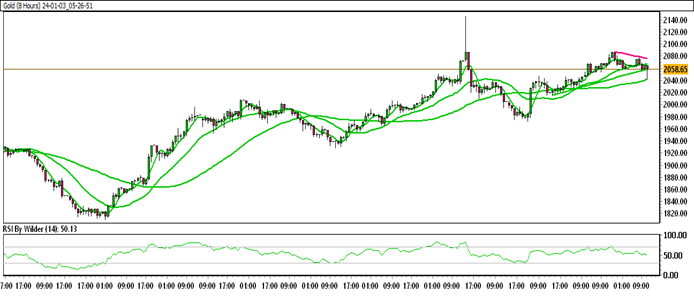

Gold is currently trading within an up channel.

Gold is positioned below 20&50 the Moving Average (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 2066.88

Immediate support level: 2054.09

HOW TO TRADE GOLD

After a substantial rise, gold encountered rejection, leading to a decline. Although attempting to maintain its upward movement, gold consistently encounters resistance. Presently, gold is approaching its initial support level, and a breach of this level could signal further downside potential.

TRADE SUGGESTION- STOP SELL– 2048.83, TAKE PROFIT AT- 2009.73, SL AT- 2078.16.