AUD/USD slips off 200-day SMA resistance, but a weaker USD prevents any significant decline.

FUNDAMENTAL OVERVIEW

The AUD/USD pair experiences some intraday selling on Tuesday near the 0.6700 level as it tries to break through the crucial 200-day Simple Moving Average (SMA).

The minor intraday pullback, on the other hand, lacks a clear structural driver and is more likely to be cushioned as a result of the pervasive pessimistic sentiment around the US Dollar (USD). The USD Index (DXY), which measures the value of the dollar against a basket of currencies, falls to a two-month low as speculation grows that the Federal Reserve (Fed) has reached the limit of its ability to raise rates and is nearing the end of its rate-hiking cycle. This should, in turn, serve as a positive force for the AUD/USD pair and restrict any significant decline.

The labor market is slowing down, according to the carefully monitored US employment figures released on Friday, which revealed that the economy added the fewest jobs in 2-1/2 years in June. Furthermore. The one-year consumer inflation expectation decreased to 3.8% in June, the lowest level since April 2021, according to the New York Fed’s monthly poll, which was released on Monday. This would enable the US central bank to moderate its hawkish position, which would further reduce the yields on US Treasury bonds and further reduce demand for the US dollar.

In addition, a steady performance on the equity markets lessens the US dollar’s perceived safe-haven character, which should help the risk-averse Australian. Nevertheless, it would be wise to hold off on making new bullish wagers around the AUD/USD pair until some follow-through buying has occurred considering recent failures close to a theoretically key 200-day SMA. Ahead of the release of the most recent US consumer inflation data on Wednesday, which will affect the short-term USD price dynamics, traders also prefer to stay out of the market.

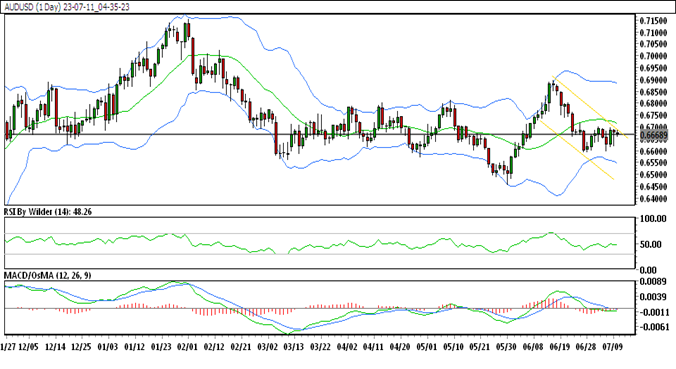

AUD/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

AUD/USD is currently trading within a down channel.

AUD/USD is positioned below 5&20 Simple Moving Averages (SMA).

The Relative Strength Index (RSI) indicates bullishness, while the Stochastic oscillator suggests up trend.

Resistance level: 0.6688

Immediate support level: 0.6660

HOW TO TRADE AUD/USD

The price of AUD/USD broke out after trading consistently in a range, but it was unable to maintain the rise, and it dropped back. The AUD/USD exchange rate is currently holding steady and has formed a double bottom. Currently, it is trading in a zone of resistance; if this zone is broken, further rise is expected.