Bitcoin price declines as US core PCE inflation rises faster than expected.

- As the US core PCE inflation rate comes in at 0.4% MoM and 4.7% YoY, the price of bitcoin falls below $26,400.

- The core PCE data are consistent with the notion that inflation is persistent and that risk assets like Bitcoin and Ethereum may fall precipitously in 2023.

- The US Federal Reserve may continue to face pressure to boost interest rates because of the PCE announcement in April 2023.

In response to the US core PCE inflation rate, the price of bitcoin dropped. The asset fell below $26,400 because of market participants’ knee-jerk reaction, which escalated selling pressure.

In response to US core PCE inflation data, the price of bitcoin plummets.

Market participants anticipated rate decreases from the US Federal Reserve as of last week. At 0.4% MoM and 4.7% YoY, the US core PCE inflation rate exceeded expectations and confirmed concerns about an impending interest rate increase.

The increase in selling pressure on the currency is expected to postpone Bitcoin’s ascent to its bullish target of $30,000. The trading climate is not as favorable for risk assets as traders had anticipated, and tighter market circumstances may cause Bitcoin and Ethereum selling to become even more intense.

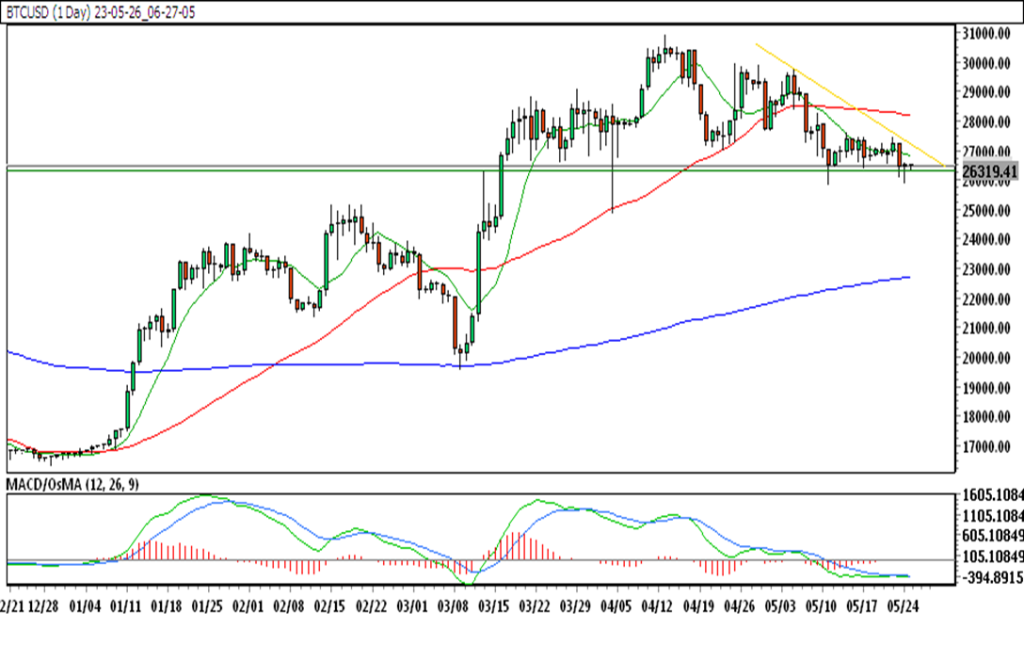

The announcement of the US PCE inflation rate has pushed the price of Bitcoin lower, which is currently in a downward trend. At $26,319 and $26,220, two levels that previously supported the asset, BTC could find support.

At $26,446, $26,440, and $26,473, respectively, the price is trading below its three long-term exponential moving averages, the 10, 50, and 200-day.

As there is no indication that inflation will decrease soon, investors are likely to shift their money to different industries and return to safe havens. Gains in the price of Bitcoin and Ethereum are likely to be brief before risk assets are put to the test by a lengthier, more substantial slump.