Unlock New Avenues with Bond Trading

Welcome to the realm of bond trading – your gateway to portfolio diversification and financial growth! Are you ready to explore the world of fixed income investment? Look no further! Investing in bonds offers a unique opportunity to broaden your investment horizon and make profits by speculating on the fluctuation in the value of corporate and government bonds.

Diversifying your investment portfolio is crucial for mitigating risk and optimizing returns. Bonds, also known as fixed income assets, play a vital role in achieving this diversification. By adding bonds to your investment mix, you can balance out the volatility of other assets and create a more resilient portfolio.

The bond market is a space where investors lend money to governments or companies in exchange for regular interest payments. On the other hand, traders engage in bond trading by speculating on the value of these underlying bonds. This dual nature of bonds creates a dynamic environment for both investors and traders, offering avenues for both stable income and potential capital gains.

Cost efficient Trading

Trade the bonds market in a cost efficient way with exceptional margin and low commission charges.

Go long or short

Trade the market from any direction, trade can go long or short according to their strategy.

Enhanced Accessibility

CSFX provides you instant and direct access to the global fixed-income markets.

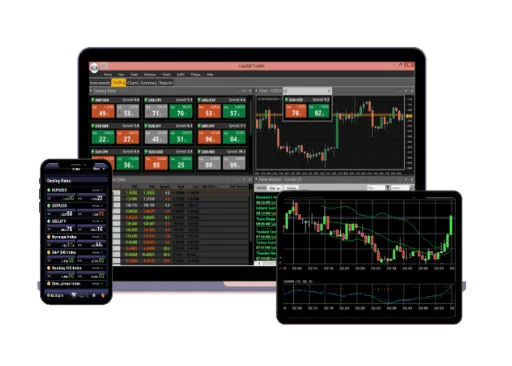

Multiple Trade platforms

CSFX provides you a range of platforms for mobile, windows and tablets.

Vast range of market

Trade in the words popular bond markets such as U.S. Bonds, Euro-Bonds, Japan Bonds etc.

NO hidden charges

Trade can increase their returns as we charges very nominal omission rate with no hidden charges.

Unveiling the World of Bond Trading

Bonds have a unique relationship with interest rates. As interest rates fluctuate, the price of bonds responds inversely. This means that when interest rates rise, bond prices tend to fall, and vice versa. Understanding this relationship allows traders and investors to make informed decisions that align with market dynamics.

Spread betting, a popular financial derivative, offers traders the opportunity to speculate on bond market prices without owning the physical assets. This innovative approach enables traders to potentially profit from both rising and falling bond prices, adding versatility to trading strategies.

BASIC

$100

Leverage: 2500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.5

Open Orders: 300

CLASSIC

$200

Leverage: 3000 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.0

Open Orders: 300

PROFESSIONAL

$200

Leverage: 3500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 1.5

Open Orders: 300

VIP

$10,000

Leverage: 100 (Request For More)

Spreads Types: Fixed/Variable

Spreads from (pips): 0.1

Open Orders: 400

Bonds Desktop Trader →

Our most popular platform, Capital Trader is designed with a wide range of investors and traders in mind.

Bonds WEB TRADER LITE →

The most difficult and testing circumstances require a platform that provides clients critical market access

Bonds Web Trader →

Application is a lightweight that can be accessed from anywhere using an internet connection and computer.

Bonds Mobile Trader →

Introducing Mobile Trader, a complete mobile trading solution for the Android and iOS platforms

Bond trading is a way of speculating to make a profit from the price movement of government bonds and corporate bonds. The high-interest rate makes bonds less attractive as bond prices and interest rates tend to have an inverse relationship.

Bond is counted in fixed income or fixed return instrument, but due to market conditions and frequently buying and selling causes fluctuation in its price, so trader sees this an opportunity and use different financial derivatives to speculate on bonds..

Bonds are fixed-income instruments with low risk and low returns. The bonds are viewed as safer instruments as compared to any other instrument. Traders and investors use it to manage risk and to diversify their portfolio.

Capital street offer, investors and traders an opportunity to invest or trade in the world’s most popular U.S 10years treasury and U.S 30year treasury bond.