Oil prices remain stable in trading preceding Thanksgiving, anticipating OPEC+ production cuts.

FUNDAMENTAL OVERVIEW:

In the calm pre-U.S. Thanksgiving holiday trade on Wednesday, oil prices maintained a narrow range. The market awaited updates on output cuts from the OPEC+ producers’ group and sought confirmation of a substantial increase in U.S. crude stocks.

Both benchmarks have experienced declines for four consecutive weeks, with prices further weakening last week amid increasing concerns about the demand outlook. Investors exercise caution ahead of the scheduled OPEC+ meeting on Sunday, where the producer group may deliberate on intensifying supply cuts in response to a decelerating global economic growth.

Both contracts rose approximately 2% on Monday following reports from three OPEC+ sources informing Reuters that the Organization of the Petroleum Exporting Countries (OPEC) and allied producers are likely to contemplate further cuts to oil supply during their meeting on November 26.

“The forthcoming meeting has become the primary focal point for oil prices at the moment, as sentiments overlook the significant increase in U.S. crude inventories.

Analysts anticipate that OPEC+ will probably extend or intensify oil supply cuts into the upcoming year. According to ANZ analysts, the prevailing market consensus indicates an extension of voluntary cuts by Saudi Arabia and Russia into 2024, emphasizing that additional cuts by other members will be crucial for determining future prices.

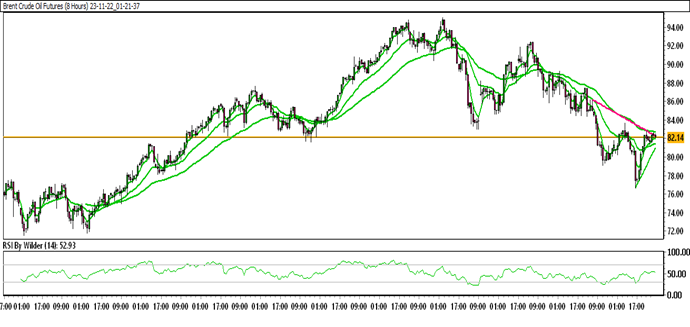

BRENT CRUDE OIL TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

Brent Crude Oil is currently trading within an up channel.

Brent Crude Oil is positioned above 5&20 Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a neutral trend.

Immediate Resistance level: 82.83

Immediate support level: 80.18

HOW TO TRADE BRENT CRUDE OIL

After a notable surge, Brent Crude Oil encountered resistance and subsequently declined. While trading on the downside, it found support and reversed to the upside. Currently, it is making attempts to move higher and approaching a crucial resistance zone. If this zone is breached on the upside, it is expected to sustain the upward momentum.

TRADE SUGGESTION- STOP BUY– 83.56, TAKE PROFIT AT- 87.49, SL AT- 81.47.