Hong Kong Stocks Surge by 4% Following China’s Assurance of Support for Struggling Real Estate Sector.

Tuesday witnessed a significant surge in Hong Kong stocks, with the Hang Seng index skyrocketing by over 4%, in response to China’s Politburo’s firm commitment to “adjust and optimize policies in a timely manner” for its beleaguered real estate sector.

Chinese Electric Car Manufacturers Propel Hang Seng Tech Index by Over 6%

The Hang Seng Tech index also saw an impressive rise, exceeding 6%, primarily fueled by the remarkable performance of Chinese electric car manufacturers.

Prioritizing Stable Employment: Beijing’s Pledge to Bolster Consumption and Tackle Debt Concerns

Beijing’s top decision-making body delivered on its promise to make stable employment a strategic goal, and additionally vowed to enhance consumption levels while addressing mounting concerns over debt.

Amidst a backdrop of lackluster economic data from last week, these policy reassurances served as a beacon of hope, instigating a rally in the Hong Kong stock market.

Mainland Chinese Stocks Surge in Tandem with Hong Kong Markets

The optimism radiating from the Chinese government’s policy reassurances extended its positive influence to all stocks on the Chinese mainland. The Shanghai Composite recorded its most substantial single-day gain since February at 3,231.52, registering a remarkable 2.13% rise. Simultaneously, the Shenzhen Component soared by 2.55%, closing at 11,021.29 – its most substantial one-day increase since October 2022.

Hong Kong’s Real Estate Equities Spearhead the Market Recovery

Hong Kong’s Hang Seng index’s 4% surge was largely attributable to China’s vow of additional support for its struggling real estate sector.

Among the index’s top gainers, Longfor Group, a prominent real estate developer, witnessed a staggering surge of almost 20%. Close behind, Country Garden Services Holdings, a leading property management company, experienced a noteworthy increase of 17.54%.

Hang Seng Tech Index Leads the Charge with Tech Giants at the Helm

The Hang Seng Tech index played a pivotal role in driving market gains with a 4.57% rise. This surge was spearheaded by electric car manufacturers, with Chinese companies like Xpeng and Nio taking the lead.

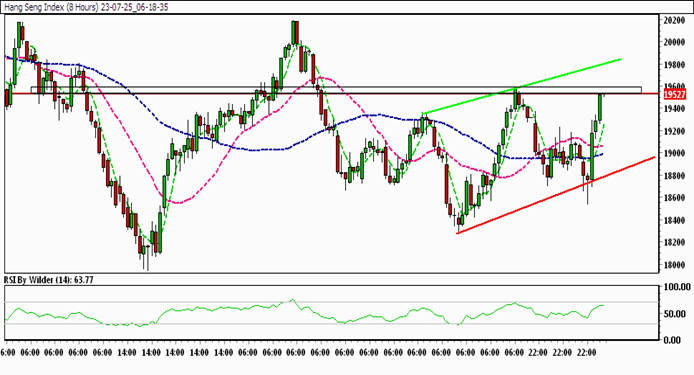

Hang Seng Technical Analysis: Indicators Signal Bullish Trend

In the current scenario, the Hang Seng index is trading within an upward channel and above all Simple Moving Averages (SMA). The Relative Strength Index (RSI) is firmly within the buying zone, pointing towards bullishness. Additionally, Stochastic indicators are suggesting an upward trend.

Key Levels to Watch

Immediate resistance is identified at 19,580, while the immediate support level lies at 19,418.

How to Navigate Hang Seng in the Upcoming Week

After experiencing a sharp decline, the Hang Seng index appears to have stabilized, with signs of an upward movement. Presently, the index is testing a significant resistance level. A successful break of this level could signal further upward momentum.

Trade Suggestion

For traders eyeing opportunities, an entry point at 19,639 could be considered, with a target set at 19,892. Implementing a stop-loss strategy at 19,451 would be prudent to manage risk.

Conclusion

The Hong Kong stock market witnessed a remarkable surge as China pledged support for its struggling real estate business. Policy reassurances and commitments to stabilize employment, boost consumption, and address debt concerns injected confidence into the market. With real estate equities and tech giants leading the charge, investors showed renewed enthusiasm. However, as with any investment, caution is advised, and traders should carefully analyze technical indicators to make informed decisions in the market.