Embark on a Profitable Journey: Start Trading Commodities

Welcome to the exciting world of commodity trading! Are you ready to diversify your investment portfolio and capitalize on global market trends? Look no further! Trading Contract for Difference (CFD) on commodities like gold and crude oil provides a unique opportunity to engage with these dynamic markets and potentially boost your financial growth.

Diversifying your investments is key to managing risk and optimizing your potential returns. Trading CFDs on commodities allows you to harness the power of precious metals like gold and vital resources like crude oil. By adding these assets to your portfolio, you can navigate market fluctuations with confidence.

Global trends shape the commodity markets, presenting lucrative opportunities for astute traders. With 24-hour trading, you can stay ahead of these trends and seize profitable moments at any time of day. Whether it’s the glittering world of gold or the dynamic realm of crude oil, our trading hours align with your ambitions.

BROAD RANGE OF MARKETS

Access to the popular commodities markets, including energy, metal and agricultural products.

TIGHT SPREAD

Spread in gold contract – 0.30 Dollar, US Light Crude crude oil spread – 0.02 Dollar

FLEXIBLE TRADING HOURS

We offer a wide range of commodity futures which can be traded 24*5 hours on our platform.

TRADE USING MARGIN

Get greater exposure to the marketplace with a small deposit and spread your capital using margin

RISK MANAGEMENT

Protect your trades against adverse movements for free and choose exactly where your trade closes with stop-loss tool.

ENHANCED FLEXIBILITY

Freedom to choose a position Size for standard or mini-contracts. Trade hassle free with multiple trading platform.

Unveiling the Commodity CFD Experience

Exploring the Commodity Market

The commodity market encompasses a variety of valuable resources, including gold, oil, gas, coffee, and more. At your fingertips, you have the chance to trade these commodities through CFD contracts, allowing you to speculate on price movements without owning the physical assets. Alternatively, you can invest in commodities by trading futures contracts, opening doors to a world of potential profits.

Oil: A Global Economic Force

Among the most traded commodities, oil takes center stage. Its economic significance on the global stage makes it a popular instrument among traders. As the backbone of various industries and a part of our daily lives, the shifts in oil prices resonate far and wide, affecting both active traders and the general population.

BASIC

$100

Leverage: 2500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.5

Open Orders: 300

CLASSIC

$200

Leverage: 3000 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.0

Open Orders: 300

PROFESSIONAL

$200

Leverage: 3500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 1.5

Open Orders: 300

VIP

$10,000

Leverage: 100 (Request For More)

Spreads Types: Fixed/Variable

Spreads from (pips): 0.1

Open Orders: 400

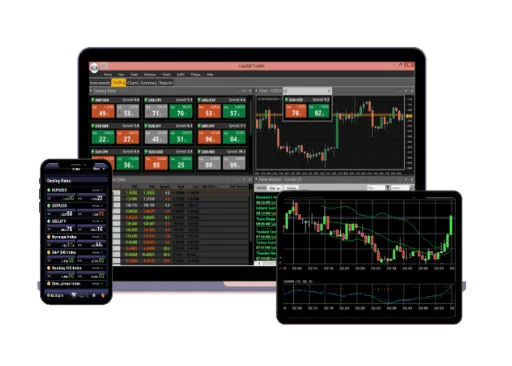

Commodity Desktop Trader →

Our most popular platform, Capital Trader is designed with a wide range of investors and traders in mind.

Commodity WEB TRADER LITE →

The most difficult and testing circumstances require a platform that provides clients critical market access

Commodity Web Trader →

Application is a lightweight that can be accessed from anywhere using an internet connection and computer.

Commodity Mobile Trader →

Introducing Mobile Trader, a complete mobile trading solution for the Android and iOS platforms

Commodity trading is an old profession, older than trading stocks or bonds. It was an essential business, but as technology developed, it became a popular market among the traders. Commodity trading deals with buying and selling metals such as gold and silver, energy commodities such as oil and natural gas, an agricultural commodity such as cotton and rice, etc. supply and demand generally drive the commodity market. Higher demand leads to higher prices and vice-versa.

The commodity is widely used as a hedge against inflation, although it provides benefits like portfolio diversification, and it offers protection during inflation and at times of economic uncertainty. The commodity market can give profitable returns with huge swings in prices. Capital street provides lower trade margins, which can be low as 5 to 10 % of the total value of the contract, which is lower compared to any other asset class.

Commodities are traded on many exchanges, and by opening an account with a broker, you can trade the commodity market without any problem. Commodity markets are generally traded as futures contracts. Futures contracts are agreements to buy or sell an underlying asset at an agreed price and date in the future. This helps you to trade the contracts without ever owning the commodity in real.

Trading commodity with capital street provides a bunch of benefits, as we are one of the most trusted brands of CFDs broker. Capital street provides you features like the safety of funds, increased continuous transparency charting with historical data for the last five to eight years. We also provide tools for risk management and higher leverage to maximize your profit and to limit your losses.

Tradable commodity falls in for major categories, which consist of different instruments related to those particular categories. An investor can invest in metal commodities that consist of assets like gold, silver, platinum, etc., Energy commodities which consist of assets like crude oil, natural gas, and gasoline, etc., livestock and meat commodities which consist of assets Like lean hogs, pork, live cattle: Etc, Agricultural commodities which include corn, wheat, rice coffee and cotton etc.

Capital street provides you with a range of financial services. For beginners who want to practice trading and for professionals who want to back-test their strategy can do on the capital street with the help of a demo account. This account provides you the freedom to trade the live market without risking your actual capital. The capital street also gives you eBooks and blogs to improve your trading.