WTI records slight increases near $79.00 due to a drawdown in US crude stocks.

FUNDAMENTAL OVERVIEW:

- On Thursday, WTI price inches up to $79.71.

- According to the EIA, US crude stocks declined by 1.4 million barrels last week.

- Recent trading sessions have seen WTI prices impacted by prospects of a ceasefire in Gaza.

On Thursday, Western Texas Intermediate (WTI), the benchmark for US crude oil, hovers around $79.00. Following an unexpected drawdown in US crude stocks, the commodity rebounds from losses.

According to Wednesday’s report from the Energy Information Administration (EIA), crude inventories for the week ending May 3 dropped by 1.4 million barrels to 459.5 million barrels, contrasting the previous week’s build of 7.3 million barrels. Market expectations had predicted a decrease of 1.4 million barrels. A reduction in oil inventories could potentially bolster WTI prices, indicating a rise in demand.

Geopolitical developments in the Middle East, particularly discussions surrounding a Gaza ceasefire, are closely watched by the United States. CIA Director William Burns’s visit to Israel, where he met with Prime Minister Benjamin Netanyahu, underscores this attention. Any easing of tensions in the region may exert pressure on WTI prices.

The Organization of the Petroleum Exporting Countries (OPEC) and its partners, collectively referred to as OPEC+, have scheduled a meeting for June 1 to deliberate on their production strategy. However, Russian Deputy Prime Minister Alexander Novak indicated on Tuesday that there are presently no discussions within OPEC+ regarding a potential increase in oil output.

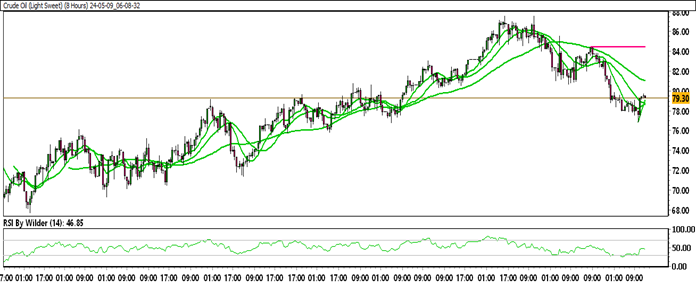

CRUDE OIL TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Crude Oil is currently trading within a down channel.

Crude Oil is positioned below the 5&20 Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Neutral zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 80.20

Immediate support level: 77.56

HOW TO TRADE CRUDE OIL

After a significant surge, crude oil encountered resistance and formed a double-top pattern, resulting in a sharp decline in prices. Currently, it has breached a crucial support level and is trading below it. Following this decline, a minor correction is anticipated. However, it is currently approaching a resistance zone, and if it faces rejection there, further downside movement is likely.