Walt Disney shares drop more than 9% following quarterly results.

FUNDAMENTAL OVERVIEW:

Shares of Walt Disney Co. plunged by over 9% on Tuesday, after the media giant’s release of its quarterly financial results and forecasts for the ongoing quarter.

The direct-to-consumer sector, encompassing Disney and Hulu, reported a quarterly operating income of $47 million, contrasting with a loss of $587 million from the previous year.

In the merged streaming enterprises, encompassing Disney, Hulu, and ESPN, the second-quarter operating loss decreased to $18 million from $659 million, while revenue increased to $6.19 billion from $5.51 billion.

In the second quarter, the company gained over 6 million subscribers to its Disney streaming platform.

According to Walt Disney’s chief financial officer, Hugh Johnston, the company anticipates no growth in core Disney subscribers for the ongoing quarter, and streaming profitability will be impacted by increased expenses for cricket rights in India.

The company reported an impairment charge of approximately $2 billion in the second quarter, connected to the India deal and its traditional television networks.

Anticipated profitability for its entire streaming business is forecasted for the fourth quarter.

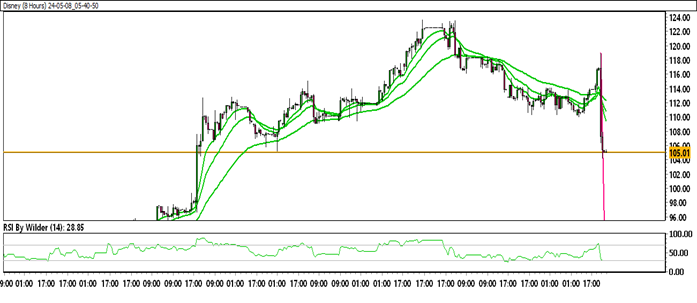

DISNEY TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Disney is trading within a down channel.

Disney is moving below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Selling zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 107.29

Immediate support level: 104.14

HOW TO TRADE DISNEY

After a significant price rise, Disney encountered rejection and formed a bearish engulfing pattern at the peak. Consequently, it reverted to the downside and began falling aggressively. Presently, it has breached its previous support and swing low. A minor correction or retest is anticipated before further decline in Disney’s stock.