EUR/USD declines as the US Dollar strengthens following a positive US Non-Farm Payrolls report

FUNDAMENTAL OVERVIEW:

- EUR/USD drops from 1.0900 as a positive May US NFP report enhances the US Dollar’s appeal.

- The NFP report indicates further tightening of labor market conditions.

- Meanwhile, the ECB has begun its policy easing campaign but avoided committing to a specific interest rate trajectory.

EUR/USD experienced a significant sell-off, dropping to around 1.0840 during Friday’s New York session, following the May US Nonfarm Payrolls (NFP) report which revealed stronger-than-expected labor demand and wage growth. The Employment report showed that US employers added 272K new payrolls, surpassing the expectations of 185K and the previous figure of 165K, which was revised down from 175K. However, the Unemployment Rate increased to 4.0%, up from both the estimated and prior rate of 3.9%.

Higher-than-expected payroll numbers are likely to dispel concerns about weakening labor demand, which had intensified following recent employment indicators suggesting a loosening job market. April’s JOLTS Job Openings data and May’s ADP Employment Change both came in below expectations. Additionally, Initial Jobless Claims for the week ending May 31 were higher than anticipated, indicating some easing in the labor market.

Meanwhile, Average Hourly Earnings, which gauges wage inflation, accelerated to 4.1% year-on-year, surpassing expectations of 3.9% and the previous figure of 4.0%, which was revised upward from 3.9%. Every month, wage inflation grew at a strong rate of 0.4%, exceeding the consensus of 0.3% and the previous reading of 0.2%. This has heightened concerns about persistent inflation, negatively affecting market expectations for the Federal Reserve to begin reducing interest rates starting from the September meeting.

EUR/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

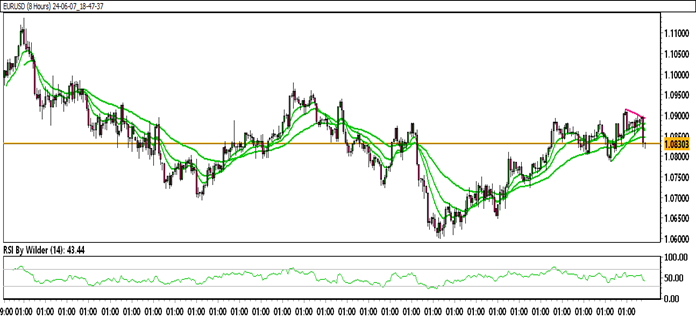

EUR/USD is trading within an up channel.

EUR/USD is moving below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in a Neutral zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 1.0866

Immediate support level: 1.0810

HOW TO TRADE EUR/USD

After declining, EUR/USD found support and reversed to the upside, beginning to trade within an upward channel and forming higher highs. Despite multiple attempts, EUR/USD has been unable to break through its resistance level and has faced rejection. Currently, EUR/USD may retest its support zone on the downside.