Before the US CPI inflation data, the EUR/USD reaches monthly highs above 1.0800.

FUNDAMENTAL OVERVIEW

Following an unexpected increase to -8.5 in June in Germany’s Economic Sentiment, the EUR/USD is currently trading over 1.0800 and flirting with monthly highs. The US Dollar follows the US Treasury bond yields lower as there are prospects for weak US CPI data, keeping the pair on the offensive.

After Monday’s erratic trading, EUR/USD gathered momentum and rose beyond 1.0800 in the European morning to reach its highest point in three weeks. The US dollar’s (USD) value and the movement of the pair may be heavily impacted by US inflation statistics from May later in the session.

The USD is unable to find demand due to the positive market sentiment, which helps the EUR/USD pair advance early on Tuesday. The Euro Stoxx 50 Index is up more than 0.5%, and US stock futures are climbing between 0.1% and 0.5%, reflecting the risk-positive market sentiment.

The CME Group Fed Watch Tool indicates that markets continue to factor in a nearly 25% likelihood that the Federal Reserve (Fed) will increase its policy rate by 25 basis points (bps) on Wednesday. Therefore, a lower-than-anticipated rise in the monthly Core CPI could confirm that the Fed will not adjust its interest rate and lead to further USD weakness relative to its competitors. On the other side, if Core CPI inflation increases at a faster rate in May, EUR/USD may experience fresh bearish pressure.

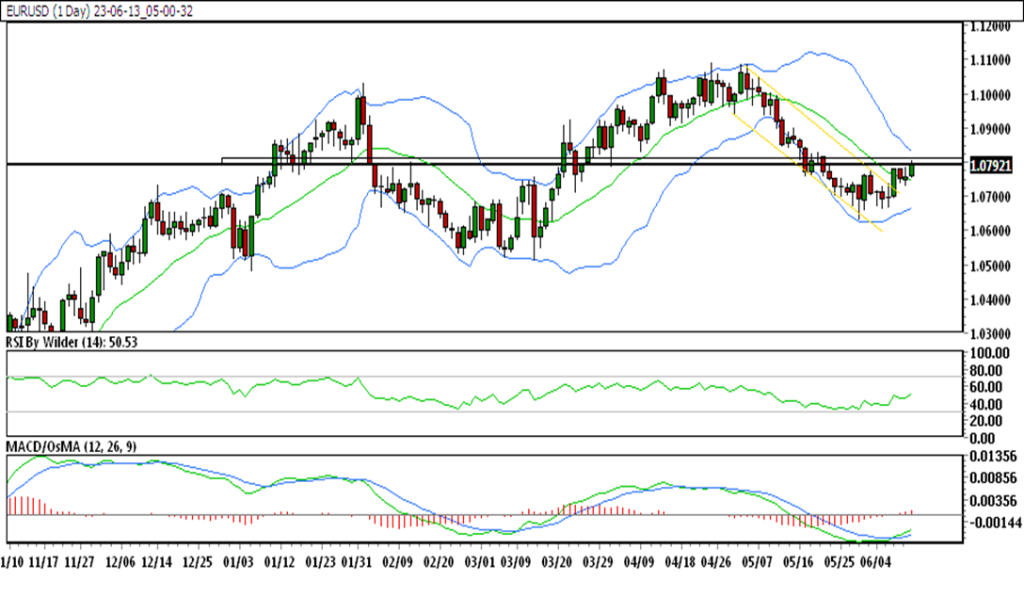

EUR/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

EUR/USD is trading in the down channel.

EUR/USD currently trading above 5&20 SMA.

RSI is in buying zone which suggests bullishness and Stochastic is suggesting up trend.

EUR/USD resistance is at 1.07942 & its immediate support level is 1.07518

HOW TO TRADE EUR/USD

Following a severe decline, the price of EUR/USD indicated interest in rising. Price currently moving in a resistance area after breaking the previous day’s high. Further upside is possible if this zone is broken.