EUR/USD Holds Steady around 1.0900 Ahead of Lagarde’s Speech.

Fundamental Overview

On Monday, the EUR/USD currency pair maintains its stability, remaining within its daily range near 1.0900. The pair’s recovery is currently influenced by the cautious sentiment prevailing in the market, as reflected by the mixed morning performance of Wall Street. The European Central Bank (ECB) Forum on Central Banking is set to commence, featuring a speech by ECB President Lagarde.

European Trading Hours Witness Recovery in EUR/USD Pair

During the European trading hours, the EUR/USD pair extends its recovery from Friday and traded close to the 1.0920 level. Despite the release of below-par German data, the US Dollar experiences a decline against most major currencies, while the Euro strengthens. The June IFO Survey reveals a decline in the business climate, falling from 91.5 to 88.5, surpassing initial expectations. Although the evaluation of the existing situation shows slight improvement, expectations have also decreased, registering at 83.6.

Weekend News Sets a Gloomy Tone

Over the weekend, various concerning events unfolded, including a mercenary uprising in Russia under President Vladimir Putin’s administration and China’s ongoing efforts to recover its economy. As a consequence, market participants find it challenging to adopt an optimistic outlook, as evidenced by the lackluster performance of global markets.

Focus on Inflation in the Week Ahead

Inflation will take center stage during the upcoming week, with both the United States and Eurozone releasing the core PCE Price Index, the preferred inflation indicator of the Federal Reserve (Fed). Additionally, Germany and the Eurozone will publish early estimates of the June Harmonised Index of Consumer Prices (HICP).

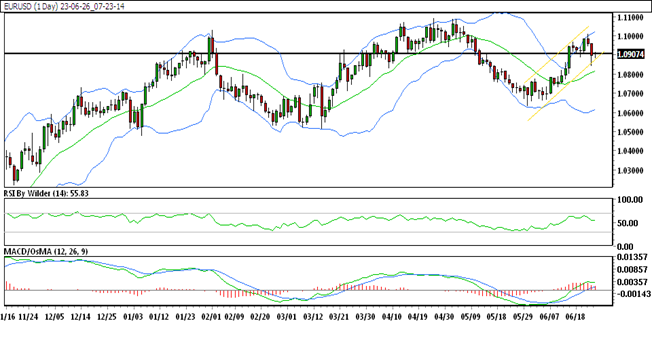

EUR/USD Technical Analysis Daily Chart

Technical Overview

- EUR/USD is currently trading within an upward channel.

- The pair remains positioned above all Simple Moving Averages (SMA).

- The Relative Strength Index (RSI) suggests a bullish sentiment, while the Stochastic oscillator indicates a possible uptrend.

- Resistance level: 1.09087

- Immediate support level: 1.08638

How to Trade EUR/USD

Following a brief period of decline, the price of EUR/USD has once again witnessed a rapid increase. The pair is currently trading at a significant resistance level, and a potential further upside is anticipated if this level is breached.

Trade Suggestion

- Entry: Buy at 1.0908

- Take Profit: 1.0959

- Stop Loss: 1.0882

Frequently Asked Questions (FAQs)

1. What is the current trading range of EUR/USD?

The EUR/USD pair is currently trading within a daily range near 1.0900.

2. Which event is expected to influence EUR/USD trading this week?

The ECB Forum on Central Banking, featuring a speech by ECB President Lagarde, is expected to impact the EUR/USD pair.

3. What is the significance of the core PCE Price Index?

The core PCE Price Index is the preferred inflation indicator of the Federal Reserve (Fed) and holds significance for both the United States and Eurozone.

4. What technical indicators suggest bullishness for EUR/USD?

The Relative Strength Index (RSI) indicates a bullish sentiment, while the Stochastic oscillator suggests a potential uptrend for the EUR/USD pair.

5. What resistance and support levels are important for EUR/USD?

The resistance level to watch is 1.09087, while the immediate support level is at 1.08638.

6. What is the trade suggestion for EUR/USD?

Consider buying at 1.0908, setting a take profit at 1.0959, and a stop loss at 1.0882.

Conclusion

As the EUR/USD pair maintains its stability around 1.0900, market participants eagerly await ECB President Lagarde’s speech at the ECB Forum on Central Banking. Despite subpar German data and ongoing global concerns, the Euro strengthens against the US Dollar. This week, the focus will be on inflation, with the release of core PCE Price Index figures from both the US and Eurozone. Traders should closely monitor the technical indicators and resistance/support levels to make informed trading decisions.