EUR/USD Remains Stable near 1.0950: A Consolidation Phase Begins.

FUNDAMENTAL OVERVIEW

On Monday, the EUR/USD experienced stability as it fluctuated within a constrained channel, hovering around the 1.0950 mark. Following a significant surge on Friday, the pair has now entered a consolidation phase, with investors eagerly anticipating the next stimulus. However, the release of the Eurozone’s Sentix Investor Confidence earlier in the day revealed disappointing results compared to expectations.

Short-Term Bullish Bias Maintained

Despite the previous surge, the EUR/USD remains relatively calm and continues to trade within a narrow channel near 1.0950. The technical analysis of the pair suggests a short-term bullish bias, with sellers likely to stay away from the market as long as the support level at 1.0920 holds steady.

Weak US Dollar Impacted by Labor Market Statistics

Prior to the weekend, the US Dollar (USD) witnessed a sell-off due to weak labor market statistics. As a result, the EUR/USD pair concluded the week in positive territory. The Non-Farm Payroll (NFP) data for June showed an increase of 209,000 jobs, falling short of the market’s expectation of 225,000 growth. Although the Unemployment Rate decreased slightly as predicted, reaching 3.6%, the USD struggled to maintain its strength against its major counterparts.

Euro’s Strength Challenged by Cautionary Remarks

Meanwhile, the Euro is facing challenges in maintaining its strength due to cautious remarks from European Central Bank (ECB) officials. In a recent speech, ECB Governing Council member Mario Centeno expressed his anticipation of inflation in the Eurozone falling below 3% by the end of the year. Another ECB policymaker, Francois Villeroy de Galhau, stated that “Eurozone rates will soon reach their high point, but it will be more of a high plateau than a peak.”

Risk Perception Influences Afternoon Behavior

In the absence of significant data releases, the afternoon behavior of the EUR/USD is likely to be determined by risk perception. During the European session, US market index futures experienced a decline ranging between 0.3% and 0.4%. If this extended decline continues and Wall Street opens on a gloomy note, it could potentially strengthen the USD and exert pressure on the EUR/USD pair.

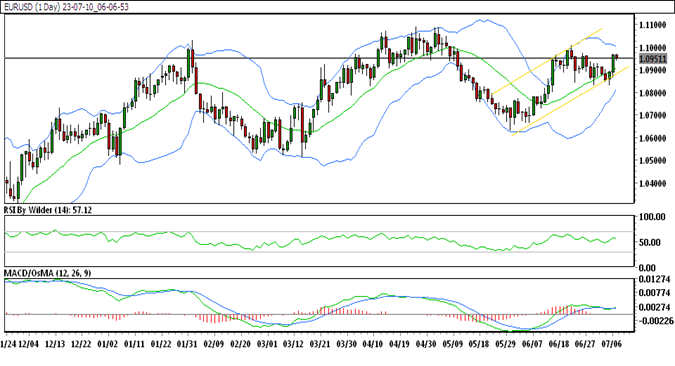

EUR/USD TECHNICAL ANALYSIS DAILY CHART

Technical Overview

Here is a technical overview of the EUR/USD based on the daily chart:

- EUR/USD is currently trading within an upward channel.

- The pair is positioned above all Simple Moving Averages (SMA).

- The Relative Strength Index (RSI) indicates bullishness, while the Stochastic oscillator suggests an upward trend.

Key Levels

- Resistance level: 1.0969

- Immediate support level: 1.09535

HOW TO TRADE EUR/USD

Following a rapid increase, the price of EUR/USD experienced a temporary decline before resuming its upward movement. Currently, the pair is attempting to break its recent swing high and is trading within a significant resistance zone. If this zone is breached, it is reasonable to expect further upside potential.

Trade Suggestion

- Buy at 1.0954

- Take Profit at 1.0979

- Stop Loss at 1.0931

Conclusion

In conclusion, the EUR/USD pair remained stable near 1.0950, entering a consolidation phase after a previous surge. Investor confidence was dampened by disappointing results from the Eurozone’s Sentix Investor Confidence report. The USD faced challenges due to weak labor market statistics, while cautious remarks from ECB officials impacted the Euro’s strength. Risk perception will play a crucial role in determining the afternoon behavior of EUR/USD. Based on technical analysis, the pair shows a short-term bullish bias, with key resistance and support levels identified.

Frequently Asked Questions (FAQs)

Q: What is the current trading range for EUR/USD?

A: The current trading range for EUR/USD is constrained around the 1.0950 mark.

Q: What factors influenced the stability of EUR/USD?

A: The stability of EUR/USD can be attributed to the consolidation phase after a previous surge and the anticipation of the next stimulus.

Q: How did weak labor market statistics impact the USD?

A: Weak labor market statistics led to a sell-off of the USD, causing the EUR/USD pair to end the week in positive territory.

Q: What were the results of the Eurozone’s Sentix Investor Confidence?

A: The Sentix Investor Confidence for the Eurozone revealed results that were worse than anticipated.

Q: What are the key resistance and support levels for EUR/USD?

A: The key resistance level is at 1.0969, while the immediate support level is at 1.09535.

Q: What is the outlook for EUR/USD trading?

A: The technical analysis suggests a short-term bullish bias, with the possibility of further upside if the resistance zone is breached.