EUR/USD Bears Eyeing 1.0900 as Negative Sentiment and Higher Yields Strengthen US Dollar.

Introduction

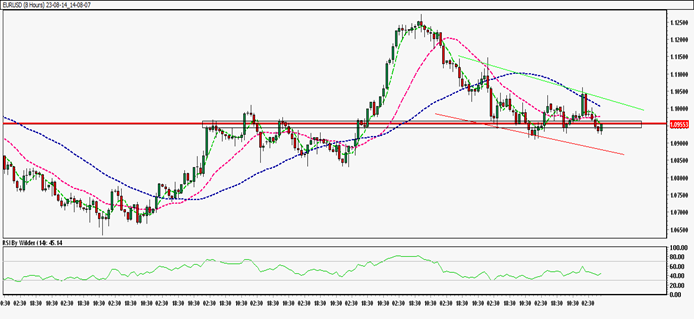

In the dynamic landscape of forex trading, the EUR/USD currency pair is currently grappling with a two-day losing streak, marking a significant descent to a fresh one-week low, hovering precariously around the 1.0930 mark. This decline has been precipitated by the convergence of negative sentiment and the surge in yields that has bolstered the US dollar’s strength. As we delve deeper into this market movement, we witness the Euro pair navigate through a pivotal juncture – breaching the support-turned-resistance line established in late May and encountering both a critical short-term support line and the 100-day moving average (DMA). These shifts in technical dynamics have set the stage for a potential change in the trajectory of this forex pair.

Fundamental Overview

Resilience Amidst Uncertainty

EUR/USD’s recent trajectory has seen it commence the week on a bearish note, slipping below the psychological barrier of 1.0930, marking its lowest point over the past ten days. This decline resonates with the prevailing technical outlook that hints at a persistent negative bias. The unfolding of this narrative has been greatly influenced by the overarching market sentiment, characterized by the re-emergence of concerns pertaining to the Chinese real estate sector. This resurgence of anxiety has injected a sense of caution into the Asian trading hours, as investors grapple with the potential reverberations of this crisis on the global economic landscape.

Dance of the Markets

US stock index futures presented a dichotomy in the European morning, pivoting from their earlier bearish stance to a state of equilibrium. This transition in sentiment has lent support to the EUR/USD, offering a respite amidst the prevailing uncertainty. As the day unfolds, the eyes of the market participants will be fixed on the events across the Atlantic, with Wall Street’s performance serving as a litmus test for the trajectory of risky assets. The interplay between key US stock indices and the US Dollar will hold sway over the fate of the EUR/USD’s trajectory in the hours ahead.

ECB’s Anticipated Moves

While the immediate economic calendar appears devoid of impactful data releases, the market’s focus remains trained on the European Central Bank (ECB). A chorus of analysts anticipates a forthcoming key rate hike by the ECB in September, a prospect highlighted by Bloomberg. However, it is noteworthy that the Euro’s valuation has not experienced significant perturbations as a result of this headline. The currency’s resilience in the face of this news underscores its multifaceted relationship with various market drivers.

EUR/USD Technical Analysis – Daily Chart

Navigating the Technical Terrain

In the realm of technical analysis, the EUR/USD finds itself ensconced within a downward channel, encapsulating the prevailing bearish momentum. This journey southwards is underscored by the fact that the currency pair is positioned beneath all Simple Moving Averages (SMA). As we delve into the oscillators, the Relative Strength Index (RSI) occupies the neutral territory, while the Stochastic oscillator offers a signal of a negative trend, accentuating the underlying bearishness.

Trade Strategy: Navigating the Storm

Unveiling Trade Opportunities

As the EUR/USD’s trajectory paints a picture of descent, traders stand at a crossroads, with strategic decisions to be made. In the wake of a pronounced rally followed by a reversal, the currency pair’s price has taken on the characteristics of a lower-low structure. This pattern holds the potential for further downward movement if a critical support zone, which the price currently orbits, succumbs to the downward pressure. The prevailing sentiment points towards a sell signal, aligning with the overarching bearish bias.

Putting Strategy into Action

Armed with this analysis, a strategic trade suggestion comes to the forefront. An entry point is identified at 1.0916, with an envisaged take-profit level at 1.0869. This tactical approach is complemented by a defined stop loss at 1.0954, safeguarding against unexpected market turbulence. This holistic strategy embodies a calculated approach to navigating the intricate currents of the forex landscape.

Conclusion: Navigating Uncertainty with Strategy

As the EUR/USD grapples with negative sentiment and the US dollar’s ascent, traders find themselves at a critical juncture. The currency pair’s trajectory, marred by recent declines, offers both challenges and opportunities. With a keen eye on technical signals and the nuanced interplay of global market dynamics, traders can navigate these turbulent waters with strategic acumen. The impending moves of the European Central Bank and the resurgent concerns in the Chinese real estate sector underscore the intricate tapestry that shapes the forex landscape. Armed with insights and foresight, traders chart a course that seeks to harness the fluctuations and capitalize on the emerging trends in the ever-evolving world of EUR/USD trading.

Frequently Asked Questions

Q: What has driven the EUR/USD currency pair’s recent decline?

A: The decline has been propelled by a confluence of negative sentiment and a surge in yields, bolstering the strength of the US dollar.

Q: What technical signals indicate the current state of the EUR/USD?

A: The currency pair is positioned beneath all Simple Moving Averages (SMA), and the Stochastic oscillator suggests a negative trend.

Q: How has the European Central Bank’s anticipated rate hike impacted the Euro’s valuation?

A: While analysts foresee a key rate hike by the ECB in September, the Euro’s value has not undergone significant fluctuations in response to this news.

Q: What potential trade strategy emerges from the current analysis?

A: Traders might consider a sell strategy, with an entry point at 1.0916, a take profit level at 1.0869, and a stop loss at 1.0954.