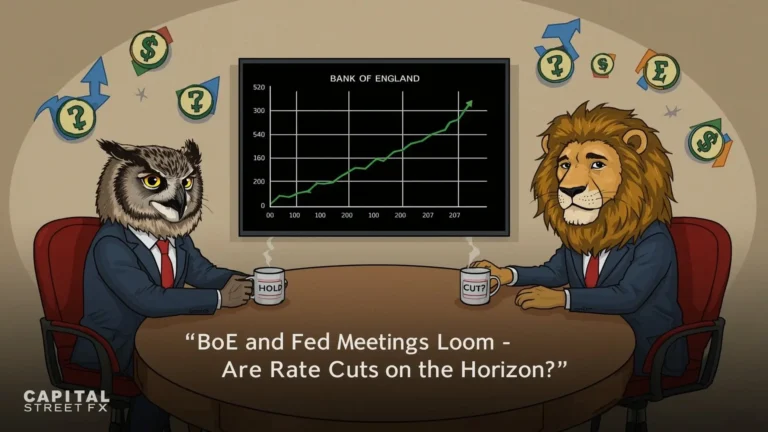

BoE and Fed meetings loom—rate cuts in spotlight this week

Oil Jumps 7% After Israeli Strikes on Iran Raise Tensions

Smarter Trading in 2025: Why MetaTrader Is Outdated

Capital Street FX vs Meta Trader – Best Trading Platform 2025

Oil Hits 7-Week High on Deal – Capital Street FX

Best Forex Bonuses & Leverage Brokers in 2025.

US Dollar Dips on Uncertainty in US-China Trade Talks.

Global Events & Weekend Forex Trading Impact.

Best Weekend Forex Trading Strategies in 2025

Should You Use High Leverage in Forex Trading?

Best Forex Brokers with the Highest Leverage.

ECB Cuts Rates Again Amid Inflation Drop & Trade Tensions

Euro Zone Inflation Falls Below ECB Target | Rate Cuts Loom in 2025

Euro zone inflation dips below ECB target in May.

XAU/USD Has Resumed Its Upward Trajectory.

Pros & Cons of High Leverage in Forex Trading.

What is Technical Analysis?

Technical analysis is a trading discipline that uses statistical trends derived from trading activity, such as price movement and volume, to analyse investments and uncover trading opportunities. Unlike fundamental analysis, which seeks to determine the value of a security based on company performance such as sales and earnings, technical analysis focuses on price and volume.

What is Technical Analysis?

At Capital Street, the Technical Analysis Report is created by analysts having rich experience in the global securities market. Their experience in technical and fundamental analysis will help you in generating profit with the safety of funds. Capital Street have immense options in the different script to trade on market simply using your mobile application, computer application or web login.

What are the benefits of Technical Analysis?

Technical analysis is an excellent method for analysing stocks and selecting the best ones. The following are some of the process’s advantages, which make it an essential component of stock trading:

- Timing the market: The major advantage of technical analysis is that it may assist you to choose when to invest and when to sell. You can detect prospective market movements by analysing technical charts and graphs, and then invest or redeem for the most successful deal.

- Analysis of market trends: Technical analysis charts assist you in determining if the market is bullish or bearish. Understanding market trends allows you to make sound investing selections.

- A complete picture of the stock price: Technical analysis of equities provides four primary price points for the stock: the starting price, the closing price, the day’s high, and the day’s low. This allows you to see the stock’s price fluctuation at a glance.

- Fixing of stop-loss targets: Stop-loss is the moment at which you cut your losses and sell equities that are continually decreasing in price. Using technical indicators, you may set a proper stop-loss objective based on your risk tolerance and plan.

- Prediction of future trends: Finally, technical analysis can assist anticipate market trend reversals and stock profitability in the future. As a result, analysts and traders utilise it to find the appropriate levels in companies with growth potential.