FTSE 100 Stocks Edge Higher Amidst Looming Deflation Concerns in China.

Introduction

In today’s trading session, the FTSE 100 saw a modest increase of 9 points, closing at 7,266. While the day lacked major breaking news, DWF Group PLC (LON: DWF) shareholders experienced a significant boost with a 37% surge in share prices. The surge came following the revelation that Inflexion Private Equity Partners LLP had approached the legal company with a bid offer. In this article, we delve into the details surrounding this development and also discuss the concerns surrounding potential deflation in the Chinese economy.

DWF Group PLC Receives Bid Approach from Inflexion Private Equity Partners LLP

DWF Group PLC, based in Manchester, announced that it had received a bid approach from Inflexion Private Equity Partners LLP. The prospective offer, if accepted, would involve a total consideration of 100p per share. This offer would consist of 97p in cash and an additional 3p special dividend for the six months ending on April 30. Responding to media speculations about a potential deal, DWF released an official statement. The company declared that if Inflexion were to present a concrete offer based on the aforementioned terms, DWF would be “minded to unanimously recommend” it to its shareholders. Inflexion has until August 7 to confirm its intention to make an offer or state its decision not to propose one, in accordance with UK takeover regulations.

China Faces Concerns of Impending Deflation

In recent times, concerns have arisen regarding the possibility of deflation in China, the world’s second-largest economy. Wholesale prices have experienced a notable decline, while consumer price inflation has marginally decreased in June. Factory gate prices have dropped at the highest rate since 2016, leading to a slowdown in demand for both consumer and manufactured goods. Consequently, the consumer price index remains unchanged on a year-over-year basis and has decreased by 0.2% compared to the previous month.

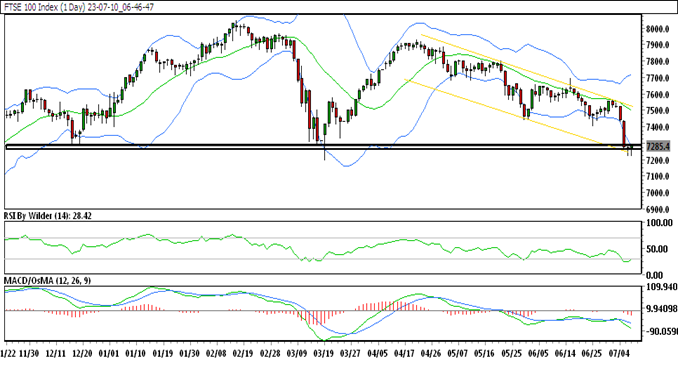

FTSE 100 Technical Analysis – Daily Chart

FTSE 100 Trades in Down Channel

The FTSE 100 is currently trading within a down channel, indicating a bearish trend in the market. Traders and investors should be cautious of this prevailing trend.

FTSE 100 Trading Below Simple Moving Averages (SMA)

Presently, the FTSE 100 is trading below all simple moving averages (SMA). This indicates a bearish sentiment in the market and suggests a potential continuation of the downward trend.

RSI and Stochastic Indicators Provide Contradicting Signals

The Relative Strength Index (RSI) is currently in the oversold zone, implying a potential bullishness in the market. On the other hand, the Stochastic indicator suggests a downward trend. Traders should carefully evaluate these contrasting signals when making trading decisions.

Key Resistance and Support Levels

The immediate resistance level for the FTSE 100 is at 7289.0, while the immediate support level is at 7232.5. Traders should monitor price movements closely around these levels as they can significantly impact market dynamics.

How to Trade FTSE 100 This Week

Reversal Possibility After Decline and Lower Low Structure

Following a steep decline and the formation of a lower-low structure, the FTSE 100 has managed to remain within a support area. At present, the price is attempting a reversal and aims to move upward. Notably, the current price has formed a bullish hammer pattern after breaking the high from the previous day. This indicates a potential for further upside movement if the resistance zone is breached.

Trade Suggestion: Buy at 7296.9, Target at 7381.5, Stop Loss at 7225.9

In light of the technical analysis and the potential reversal in the FTSE 100, a trade suggestion would be to buy at 7296.9 with a target set at 7381.5. Traders should set a stop loss at 7225.9 to manage potential risks.

Conclusion

In summary, the FTSE 100 exhibited a slight increase in today’s trading session, while DWF Group PLC experienced a significant surge in share prices following a bid approach from Inflexion Private Equity Partners LLP. Meanwhile, concerns are growing about potential deflation in China, which is evident from the decline in wholesale prices and a slowdown in consumer and manufactured goods demand. Traders should carefully analyze technical indicators and consider the potential for a reversal in the FTSE 100 before making trading decisions.

Frequently Asked Questions (FAQs)

- What was the percentage increase in the FTSE 100 during today’s trading session?

- The FTSE 100 saw a modest increase of 9 points, reflecting a positive sentiment in the market.

- Why did DWF Group PLC experience a surge in share prices?

- DWF Group PLC witnessed a significant surge in share prices as Inflexion Private Equity Partners LLP approached the company with a bid offer.

- What is the deadline for Inflexion to make an offer to DWF Group PLC?

- Inflexion has until August 7 to declare its intention to make an offer or announce that it does not plan to propose one.

- Why is China concerned about deflation?

- China is worried about deflation due to the decline in wholesale prices and the slowdown in demand for consumer and manufactured goods.

- What is the immediate support level for the FTSE 100?

- The immediate support level for the FTSE 100 is at 7232.5. It is an essential level to watch for potential market movements.

- What is the trade suggestion for the FTSE 100?

- A trade suggestion for the FTSE 100 would be to buy at 7296.9, set a target at 7381.5, and place a stop loss at 7225.9.