FTSE falls further ahead of US inflation print.

FUNDAMENTAL OVERVIEW

The FTSE was down 0.5% at 7,390.54.

On Tuesday, the FTSE 100 in Britain experienced a decline, with a downturn in Rolls Royce shares impacting the aerospace and defence sector. However, losses in the benchmark index were mitigated by miner Glencore following its stake deal with Canada’s Teck Resources.

Amidst market fluctuations, the mid-cap index displayed resilience with a 0.4% increase. Furthermore, the media sector observed a nearly 1% rise, primarily driven by Informa, whose shares saw a remarkable 6% surge. This upward momentum followed Informa’s upward revision of full-year revenue and profit estimates, indicating a more robust performance than initially expected.

Overnight, the US markets remained relatively stable, and Asian indices made modest gains as investors anxiously await consumer prices data. While there’s a sense of anticipation for a victory over inflation, central banks are cautious, pushing back against the notion that interest rates have peaked.

In the UK, diverse employment data revealed the fastest real pay growth in two years. While this may cause concern at Thread needle Street, it could be positive for consumer-oriented businesses if it translates into increased disposable income during the critical Christmas trading period.

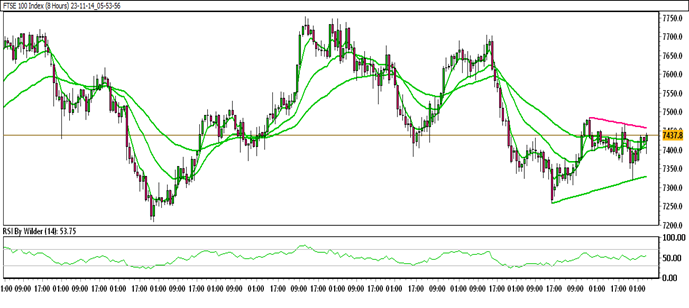

FTSE 100 TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

FTSE 100 is currently trading within a down channel.

FTSE 100 is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a positive trend.

Immediate Resistance level: 7478.2

Immediate support level: 7363.4

HOW TO TRADE FTSE 100

After a significant decline, the FTSE 100 found support, initiating an upward movement. However, it couldn’t sustain the rally for long, resulting in another fall. Presently, the FTSE 100 is making efforts to move higher, aiming for a crucial resistance level. If this level is breached, further upside potential can be anticipated.

TRADE SUGGESTION- STOP BUY– 7504.6, TAKE PROFIT AT- 7608.1, SL AT- 7436.8.