The price of gold continues its robust upward trend, reaching a new record high surpassing the $2,350 level.

FUNDAMENTAL OVERVIEW:

For the third consecutive day on Tuesday, the gold price draws in buyers, extending its positive momentum for the tenth time in the last eleven days, reaching a new all-time high in the first half of the European session.

The gold price (XAU/USD) continues to attract buyers for the third consecutive day on Tuesday, marking the tenth day of positive movement in the last eleven days. It reaches a new all-time high during the first half of the European session. However, optimism surrounding a potential ceasefire between Israel and Hamas diminishes rapidly, contributing to a cautious market sentiment. This shift acts as a significant factor driving demand for the safe-haven precious metal.

As investors seek safety, US Treasury bond yields retreat from the multi-month high reached on Monday. This defensive stance of US Dollar (USD) bulls, coupled with ongoing support for the non-yielding gold price, highlights the influence of the flight to safety. However, the anticipation of the Federal Reserve (Fed) possibly postponing interest rate cuts should mitigate significant declines in US bond yields and the USD. Consequently, this may restrict further gains in XAU/USD amid its overbought status.

Traders may opt to await additional signals regarding the Federal Reserve’s stance on interest rate cuts before making new trading decisions. As such, attention will be closely directed towards the release of March’s US consumer inflation data on Wednesday, followed by the FOMC meeting minutes. These events will significantly impact short-term USD price movements and potentially offer substantial support to the gold price.

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

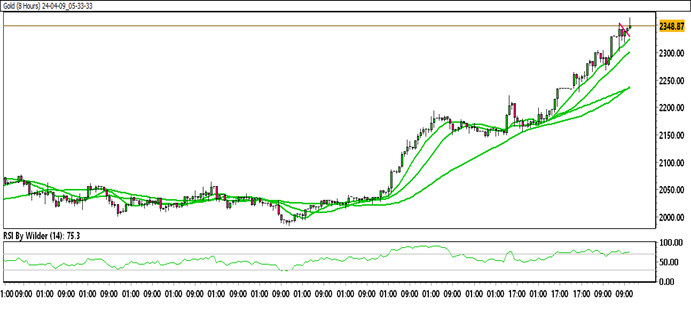

Gold is trading within an up channel.

Gold is moving above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 2363.92

Immediate support level: 2340.01

HOW TO TRADE GOLD

Gold has been consistently trading higher, reaching new peaks. Presently, it has shifted downward and is approaching a support area. Currently retracing, a minor correction is observed, with the possibility of resuming its upward movement if it follows to its Fibonacci retracement zone.