Gold prices decline amid uncertainties about rate cuts.

FUNDAMENTAL OVERVIEW:

On Wednesday, the correction of the gold price (XAU/USD) continued, propelled by a hawkish statement from Federal Reserve (Fed) Governor Christopher Waller, introducing uncertainties about a potential rate cut in the upcoming March meeting. Fed policymakers persist in advocating for prolonged higher interest rates, contrary to market expectations, citing doubts about inflation reaching the 2% target in a timely and sustainable manner.

In Asian trading on Wednesday, gold prices continued their decline, fuelled by hawkish signals from Federal Reserve officials that heightened uncertainties about the timing of interest rate cuts. Additionally, a dollar rebound further impacted gold prices.

Gold prices plummeted on Tuesday, dropping from $2,050 per ounce. This decline followed remarks from Fed Governor Christopher Waller, who advocated a prudent stance on rate cuts, citing the recent resilience in the U.S. economy, which could defer any potential reductions.

The anticipation of prolonged higher U.S. interest rates mostly counteracted the recent surge in safe-haven demand for gold, leading traders to shift away from the precious metal and towards the dollar.

Attention in the markets has shifted to the imminent release of December’s industrial production and retail sales data, scheduled for later Wednesday. Positive indications of strength in the U.S. economy, particularly in consumer spending, would provide the Federal Reserve with additional leeway to maintain higher interest rates for an extended period.

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

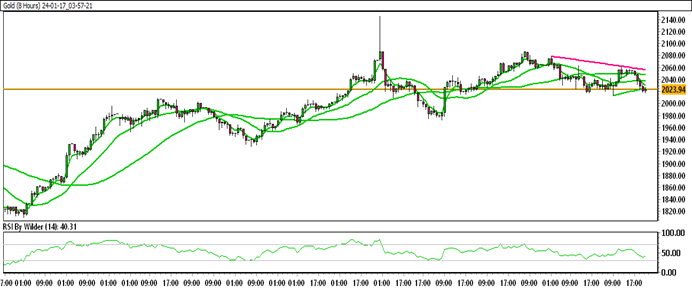

Gold is currently trading within an up channel.

Gold is positioned below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Selling zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 2039.84

Immediate support level: 2018.95

HOW TO TRADE GOLD

Gold faced resistance following a substantial upward movement, leading to a decline. Despite attempting to surpass its previous resistance, gold is currently in a downtrend and trading near a significant support zone. A breach of this zone could potentially lead to further downside.

TRADE SUGGESTION- STOP SELL– 2014.55, TAKE PROFIT AT- 1983.95, SL AT- 2037.90.