Gold finds favor as investors seek safety amid global turmoil.

FUNDAMENTAL OVERVIEW:

- Gold surges past its May highs after weaker-than-expected US inflation (CPI) and retail sales data disappoint.

- This data weakens the US dollar (USD) and suggests the possibility of faster interest rate cuts, both factors typically supportive of gold prices.

- Adding fuel to the rally is continued strong demand from central banks. Following a recent correction, gold’s uptrend resumes with a significant push higher.

Gold jumps on Wednesday after softer-than-expected US inflation (CPI) and retail sales data for April. This surprise drop weakens the US dollar and raises the possibility of earlier interest rate cuts by the Federal Reserve. Lower interest rates, or even the anticipation of them, benefit gold as they decrease the opportunity cost of holding a non-yielding asset like gold.

Gold extends its rally after softer-than-expected US inflation data from April. With US bond yields also staying low on Wednesday, the outlook for gold remains positive.

Geopolitical jitters and central bank purchases push gold prices higher, reaching nearly $2,370 on Wednesday.

Gold’s gains may be limited by Fed Chair Powell’s hawkish comments suggesting interest rates will remain high, making non-interest-bearing gold less appealing.

Heightened geopolitical risks across the globe are likely to sustain investor interest in gold, potentially pushing prices higher.

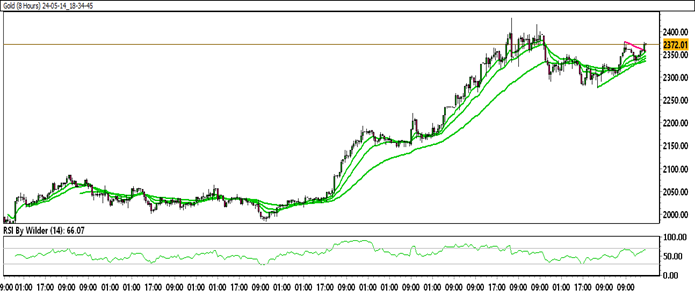

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Gold is currently trading within an up channel.

Gold is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 2378.9

Immediate support level: 2364.47

HOW TO TRADE GOLD

Gold initially rose in trading but then stabilized within a range. Subsequently, it broke out to the downside, retraced, and is now attempting an upward move. Currently, it’s hovering around a critical level. If it maintains its previous low and major support zone, gold could see further gains.