Gold Prices Decline to $1,920 Area as US Yields Rebound.

Fundamental Overview

Gold prices experienced a reversal today, dropping toward the $1,920 mark after briefly testing $1,930 earlier in the day. The main factor influencing this decline is the resurgence of the benchmark 10-year US Treasury bond yield, which has climbed back above 3.7%. As a result, maintaining its current position has become challenging for XAU/USD.

During the European session, the price of gold (XAU/USD) displayed signs of reduced volatility, settling below $1,930.00. This occurrence is primarily due to the risk-appetite theme and the consequent pressure on the US Dollar Index (DXY). The precious metal is cautiously optimistic about potential gains in this environment.

Weak Gold Outlook for the Coming Week; Resistance at $1,950-1,980 Region

Market analysts predict a continued weakness in gold prices for the upcoming week, with resistance levels expected to be encountered in the $1,950-1,980 range. The primary factors hindering gold’s performance are the rising interest rates and the strengthening of the US dollar.

Gold on Track for Worst Week Since February on Hawkish Fed

Gold prices are currently on track to record their worst week since February. Investors have grown increasingly concerned about the Federal Reserve’s aggressive stance on interest rate hikes, leading to a decline in gold’s value.

Gold Prices Set to Post Worst Week in 4-1/2 Months on Hawkish Fed

Investors’ mounting concerns over the pace of interest rate hikes by the Federal Reserve have caused gold prices to face their worst week in 4-1/2 months. The continuous upward adjustment of interest rates has prompted a negative sentiment toward gold among market participants.

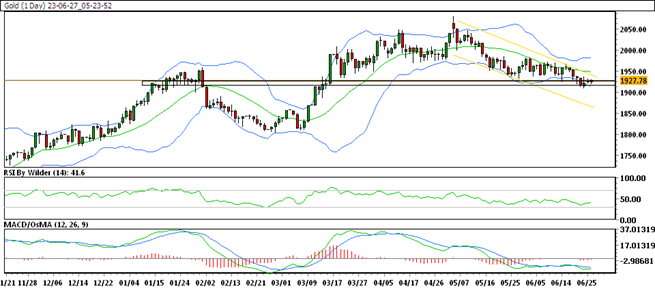

Gold Technical Analysis Daily Chart

Technical Overview

When examining the daily chart, we observe the following technical aspects:

- Gold is currently trading within a downward channel.

- The price of gold remains positioned below the 20 and 50 Simple Moving Averages (SMA).

- The Relative Strength Index (RSI) indicates a bullish outlook, while the Stochastic oscillator suggests no clear trend.

- Key resistance level: $1,930.62

- Immediate support level: $1,918.39

How to Trade Gold

Following a significant upward movement, the price of gold experienced a reversal and started trading within a downward channel. Previously, gold had been trading within a range before the subsequent downward shift. It currently finds itself at a crucial support level, and if this level is breached, further decline may be expected.

Trade Suggestion:

- Sell at $1,924.08

- Take profit at $1,909.94

- Stop loss at $1,934.96

Frequently Asked Questions (FAQs)

1. What is the main reason behind the decline in gold prices?

The primary reason for the decline in gold prices is the resurgence of interest rates and the strengthening of the US dollar.

2. How long is gold expected to remain weak?

Analysts predict that gold prices will remain weak throughout the upcoming week, with no immediate signs of a strong recovery.

3. What factors influence gold’s performance in the market?

Gold’s performance is influenced by various factors, including interest rates, the strength of the US dollar, and overall market sentiment towards risk and uncertainty.

4. Are there any potential catalysts that could reverse the downward trend in gold prices?

While it is challenging to predict exact catalysts, events such as geopolitical tensions, economic uncertainties, or shifts in central bank policies can potentially reverse the downward trend in gold prices.

5. Should investors consider selling their gold holdings given the current market conditions?

Decisions regarding buying or selling gold should be based on an individual’s investment strategy, risk tolerance, and long-term goals. It is advisable to consult with a financial advisor to make informed investment decisions.