Gold retreats following the release of US retail sales data.

FUNDAMENTAL OVERVIEW:

- Gold retreats after stronger-than-expected US retail sales data for June.

- The precious metal had been rallying following Fed Chair Jerome Powell’s positive comments on inflation progress, indicating a likely interest rate cut soon.

- Market probabilities now show a 100% chance of a rate cut at the September meeting.

Gold (XAU/USD) pulls back some early gains on Tuesday, trading in the $2,430s after US retail sales data showed robust consumer spending. The data suggests the US economy remains resilient, keeping inflation relatively elevated despite recent declines. This may influence the extent of future Federal Reserve interest rate cuts, impacting gold.

Prior to the data release, gold had been rising toward the $2,451 all-time high, driven by expectations of a September rate cut from the Federal Reserve as US inflation shows signs of cooling.

Gold rose earlier on Tuesday after Fed Chairman Jerome Powell’s Monday speech, in which he noted promising signs of inflation progress toward the central bank’s target and hinted at upcoming interest rate cuts. His comments led to a significant shift in market expectations for the Fed Funds rate trajectory.

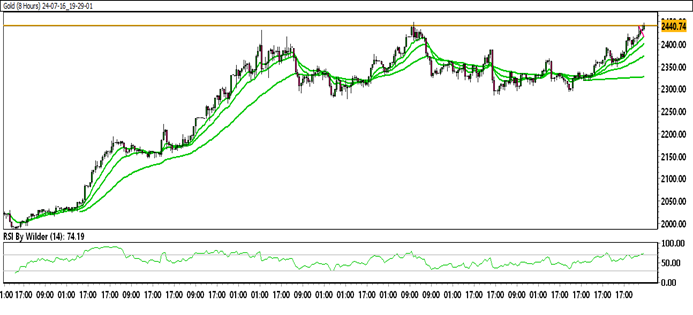

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Gold is trading within an up channel.

Gold is moving above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying Zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 2446.34

Immediate support level: 2424.70

HOW TO TRADE GOLD

After initially trading sharply higher, gold reversed to the downside and began trading within a range. Currently, gold has surged by breaking through a resistance level and is heading towards a major resistance level. It may face rejection at this level, potentially retesting its support zone before climbing.