The price of gold stops after reaching a new two-week high, and all eyes are on the FOMC minutes.

FUNDAMENTAL OVERVIEW

- On Tuesday, gold prices strongly ascended, reaching a peak surpassing two weeks.

- Supportive factors include dovish Federal Reserve expectations, declining US bond yields, and a weakened USD.

- However, a positive risk sentiment restrains additional gains as the market awaits the pivotal FOMC minutes.

Gold prices (XAU/USD) attracted strong buying interest on Tuesday, reaching a level exceeding a two-week high in the early European session, although the momentum is not sustained. Anticipating no further interest rate hikes by the Federal Reserve, the market foresees a series of rate cuts in 2024. This contributes to a continued drop in US Treasury bond yields and pulls the US Dollar (USD) to its lowest point since August 31, providing support for the precious metal.

Nevertheless, the prevailing optimistic sentiment in the equity markets, driven by expectations of additional stimulus from China, restrains further advances in the safe-haven gold price. Traders exhibit caution, refraining from aggressive bullish positions and choosing to await the release of the FOMC meeting minutes later in the US session. These minutes will offer insights into policymakers’ perspectives on potential interest rate hikes by the Fed, impacting the USD and potentially giving a renewed boost to XAU/USD.

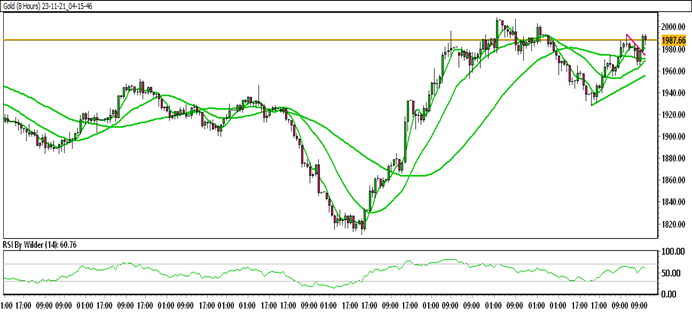

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

Gold is currently trading within an up channel.

Gold is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a neutral trend.

Immediate Resistance level: 1992.72

Immediate support level: 1968.00

HOW TO TRADE GOLD

Gold, after a significant upward surge, experienced a decline and began retracing, reaching the 50% Fibonacci level. A bullish engulfing pattern formed at this point, initiating an upward movement. Currently approaching a crucial resistance level, a potential breakthrough could lead to further upward momentum.

TRADE SUGGESTION- STOP BUY – 2000.27, TAKE PROFIT AT- 2028.42, SL AT- 1984.48.