Elevate Your Trading with Indices Trading

Welcome to the world of indices trading – a gateway to round-the-clock access to the most prominent indexes and stocks! Are you ready to immerse yourself in the dynamic world of derivatives? Look no further! Trading derivatives on popular indexes and stocks offers you a unique opportunity to engage with the global equity market and potentially boost your financial success.

WORLD TRADE INDICES

We offer more than 15 world’s most popular indices with accurate live price data.

INCREASED FLEXIBILITY

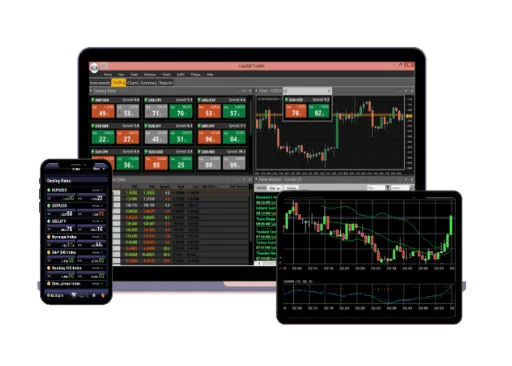

We offer freedom to choose position size for standard or mini-contracts. Multiple platforms for different devices

TIGHT SPREADS

Spreads on indices start at as low as 0.25 Dollar and 1 dollar on major indices, including the FTSE 100, the Nasdaq 100

EXCEPTIONAL LEVERAGE

Get full exposure to the market with a small initial deposit. Spread your capital across various instruments using margin and achieve greater diversification

DEEP LIQUIDITY

Guaranteed execution of every order using CSFX’s outstanding trading technology

MULTIPLE DEVICE PLATFORM

We offer a range of platforms like mobile app, web platform, windows application to make your trading experience more flexible and convenient.

The Power of Indices Trading

Unlock the power of global equity markets with indices trading. By trading derivatives linked to popular indexes, you gain direct access to the performance of multiple stocks and sectors. This allows you to capitalize on market trends and fluctuations, all while enjoying 24/5 trading hours that cater to your schedule.

Deep liquidity is the lifeblood of effective trading. When you trade indices with Capital Street, you tap into deep liquidity, ensuring smooth execution of trades even during volatile market conditions. Additionally, indices trading is cost-effective, offering a low-cost way to enter the world of global equities.

BASIC

$100

Leverage: 2500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.5

Open Orders: 300

CLASSIC

$200

Leverage: 3000 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.0

Open Orders: 300

PROFESSIONAL

$200

Leverage: 3500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 1.5

Open Orders: 300

VIP

$10,000

Leverage: 100 (Request For More)

Spreads Types: Fixed/Variable

Spreads from (pips): 0.1

Open Orders: 400

INDICES Desktop Trader →

Our most popular platform, Capital Trader is designed with a wide range of investors and traders in mind.

INDICES WEB TRADER LITE →

The most difficult and testing circumstances require a platform that provides clients critical market access

INDICES Web Trader →

Application is a lightweight that can be accessed from anywhere using an internet connection and computer.

INDICES Mobile Trader →

Introducing Mobile Trader, a complete mobile trading solution for the Android and iOS platforms

Indices are essentially a collection of individual shares; for example, the S&P 500 is a market capitalization-weighted index of 500 largest U.S public companies. Indices price movements are very volatile, and it is affected by political events, economy data like employment rate, inflation rate interest rate, etc. traders take the opportunity of this price movement. Traders cannot directly buy or sell indexes, but they can buy or sell a futures contract with a particular lot size.

Trading major indices can provide a bunch of benefits like diversification as the index represents on overall market trend and constitute of several individual stocks which minimize the risk factor. Trades get higher leverage up to 400:1 on index trading, which can help them to maximize their profit. Index trades get the facility to trade the market from long as well as the short side. Index traders get access to a wide range of markets from a single account.

Anyone who wants to learn or practice trading can open a demo trading account with the capital street. You need to fill up the basic information and email id to register the account. The trader will get ten thousand dollars of paper money in the demo account with that he can trade the live market and can improve his strategies without using your real capital.

Investing in index CFDs means you are investing in an index without actually owning the underlying index. CFDs have become very popular instruments among the trades. Capital street provides the most popular indices CFDs. Some of the world’s major and most popular indices are Dow Jones 30, S&P 500, Nasdaq 100, which represents the united states markets. DAX 30, FTSE 100, and CAC 40 represent the European stock market, and Nikkei 225, ASX 200, and Hang Seng represents the Asia-pacific market.

To invest in indices CFDs, you need to open a financial account with a CFD broker. The capital street is one of the prominent names in the market which offers a range of services like lowest margin, higher leverage, low-cost transactions, and state of the art trading platform with most popular indicators and tools. Index CFDs give you advantages like trading the market from both sides, which means you can go long as well as short on a particular index.

Liquidity means the degree of ease to which an asset or security can be bought or sold in a market without any slippage or in other words, how easily it can be converted into cash. An index is considered a highly liquid instrument as it has higher Volumes that help the trader to enter and exit with a tighter spread. High liquidity offers several advantages over instruments with low liquidity like a tighter bid-ask spread, higher open interest, multiple expiration cycles. High liquidity also attracts traders to speculate on price movements, which add to the favourable market conditions.