XAG/USD faces challenges near its weekly low and appears susceptible to further decline, particularly below the $23.00 mark.

FUNDAMENTAL OVERVIEW:

- Silver continues to endure selling pressure for the third consecutive day, hitting a weekly low.

- The technical setup indicates a tilt in favor of bearish sentiments, reinforcing the potential for further losses.

- The strong dollar and elevated yields pose challenges for silver, and speculation about a rate cut influences its outlook.

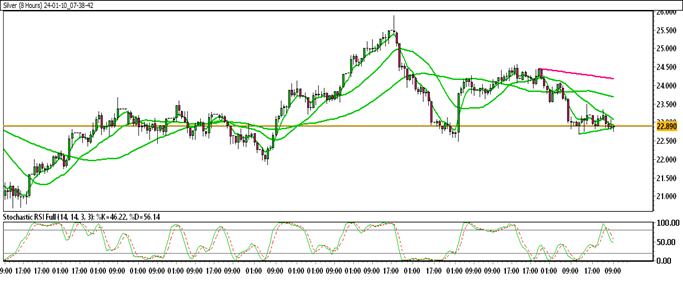

On Wednesday, Silver (XAG/USD) extends its downward trend for the third consecutive day, reaching a new weekly low around the $22.80 region in the early European session.

From a technical standpoint, the inability to sustain recovery beyond the 100-day Simple Moving Average (SMA) and the rejection near a long-standing ascending trend-line support breakpoint indicate a preference for bearish traders. Additionally, the oscillators on the daily chart, entrenched in negative territory and distant from the oversold zone, further suggest that the XAG/USD is inclined towards a downside trajectory.

The silver market is grappling with obstacles posed by a robust U.S. dollar and elevated Treasury yields. The dollar index has experienced a 1.2% increase this month, while yields on 10-year U.S. Treasury notes have surged to 4.0264%, influencing the dynamics of silver prices.

Traders are closely eyeing the imminent U.S. Consumer Price Index (CPI) report as a pivotal factor. Projections anticipate a 0.2% uptick in headline inflation for the month, with a 3.2% surge on an annual basis. The results of this report may offer valuable insights into the Federal Reserve’s considerations on interest rate adjustments, thereby impacting the potential trajectory of the silver market.

SILVER TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Silver is currently trading within a down channel.

Silver is positioned below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Selling zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 23.24

Immediate support level: 22.68

HOW TO TRADE SILVER

After experiencing a notable upward movement, silver faced a decline from the resistance level. Subsequently, it has been trading within a downward channel, forming a structure of lower lows. Silver is situated around a crucial support zone, and if this zone is breached, further downside movement is anticipated.

TRADE SUGGESTION- STOP SELL– 22.50, TAKE PROFIT AT- 21.72, SL AT- 23.06.