McDonald’s falls short of revenue estimates as quarterly sales are impacted by the conflict in the Middle East.

FUNDAMENTAL OVERVIEW:

- McDonald’s disclosed a combination of results for the fourth quarter on Monday.

- While surpassing earnings expectations, the fast-food giant fell short on revenue, attributing the shortfall to sluggish performance in international markets affected by the conflict in the Middle East.

McDonald’s unveiled varied quarterly results on Monday, with sales in Middle Eastern markets bearing the impact of ongoing turmoil.

The fast-food behemoth disclosed a fourth-quarter net income of $2.04 billion, equivalent to $2.80 per share, marking an increase from the previous year’s $1.9 billion, or $2.59 per share.

Excluding the write-off of unused software, restructuring expenses, and other items, McDonald’s achieved earnings of $2.95 per share.

Global same-store sales for the chain increased by 3.4% in the quarter, falling short of Street Account’s 4.7% estimate, mainly due to struggles in Middle Eastern sales.

The international developmental licensed markets segment experienced a mere 0.7% growth in same-store sales, with the Israel-Hamas war significantly impacting this division’s performance.

McDonald’s Middle Eastern sales suffered from boycotts linked to discounts for soldiers offered by its Israeli licensee. Temporary closures of some locations were necessary for employee safety amidst protests, aligning with a broader trend seen in Starbucks’ quarterly sales impacted by similar boycotts.

During the third quarter, McDonald’s observed a decline in U.S. traffic as low-income consumers reduced their spending, marking the initial indication that customers were becoming hesitant due to the chain’s increased prices. McDonald’s is concurrently introducing an enhanced version of its burgers on a nationwide scale, aiming to persuade customers that the elevated prices are justified.

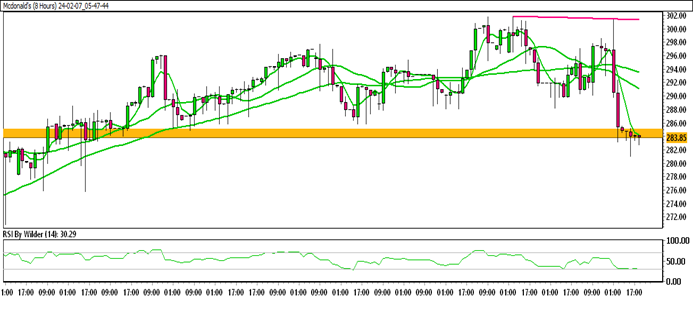

McDonald’s TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Mcdonald’s is currently trading within a down channel.

Mcdonald’s is positioned below all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Selling zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 22.54

Immediate support level: 22.29

HOW TO TRADE MACDONALD’S

Following a notable surge, McDonald’s encountered rejection, leading to a decline. Currently, it has breached its previous day’s low and is trading around a crucial support zone. If this zone is breached, there could be potential for further downside.

TRADE SUGGESTION- Stop Sell– 283.18, TAKE PROFIT AT- 275.96, SL AT- 288.83.