Nvidia shares climbed over 6% in premarket trading after reporting a significant revenue surge

FUNDAMENTAL OVERVIEW:

Shares in Nvidia (NASDAQ: NVDA) jumped over 6% in premarket trading on Thursday following the semiconductor group’s highly anticipated first-quarter results, which showed a significant surge. The company’s CEO highlighted the soaring demand for its upcoming artificial intelligence-optimized chip.

It marked another blockbuster performance for California-based Nvidia, whose data center graphics processing units have become crucial components in the infrastructure supporting the development of generative AI products.

Nvidia’s performance has become a bellwether for AI demand, significantly influencing broader market sentiment. Following the report, U.S. stock futures moved higher.

Revenue for the three months ending April 28 surged 262% year-on-year to $26 billion, surpassing Wall Street’s estimate of $24.7 billion. This growth occurred despite rising competition from AMD (NASDAQ: AMD) and Intel (NASDAQ: INTC). Data centre revenue, largely representing Nvidia’s AI chips, jumped 427% year-on-year to a record $22.6 billion.

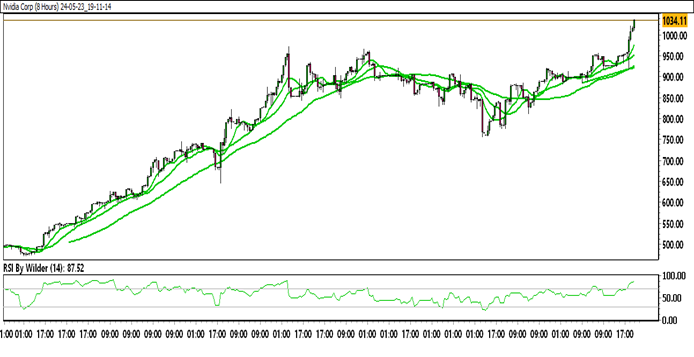

NVIDIA TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Nvidia is trading within a up channel.

Nvidia is moving above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in Buying zone, while the Stochastic oscillator suggests Positive trend.

Immediate Resistance level: 1037.85

Immediate support level: 1010.26

HOW TO TRADE NVIDIA

After a sharp rise, Nvidia stock experienced a slight retracement before resuming its upward climb. It has now surpassed its previous high and is continuing to rise. A correction around the support zone is possible, and if it holds above this level, further upside movement is likely.