NVidia’s revenue triples as the AI chip boom persists.

FUNDAMENTAL OVERVIEW:

NVidia’s stock dipped 1% in after-hours trading on Tuesday following the chipmaker’s release of fiscal third-quarter results that exceeded Wall Street expectations. However, the company cautioned about a potential adverse impact in the next quarter due to export restrictions affecting sales to organizations in China and other countries.

“We anticipate a substantial decline in our sales to these regions in the fourth quarter of fiscal 2024. Nevertheless, we are confident that this decline will be surpassed by robust growth in other geographic areas,” stated Colette Kress, NVidia’s Chief Financial Officer, in a letter addressed to shareholders.

During a conference call with analysts, Kress mentioned that Nvidia is collaborating with clients in the Middle East and China to secure U.S. government licenses for the sale of high-performance products. While Nvidia is striving to create new data centre products that align with government policies and do not necessitate licenses, Kress expressed skepticism about their significance in the fiscal fourth quarter.

In the quarter ending on October 29, Nvidia experienced a remarkable 206% year-over-year growth in revenue, as stated in an official announcement. The net income reached $9.24 billion, translating to $3.71 per share, a substantial increase from the $680 million, or 27 cents per share, reported in the corresponding quarter the previous year.

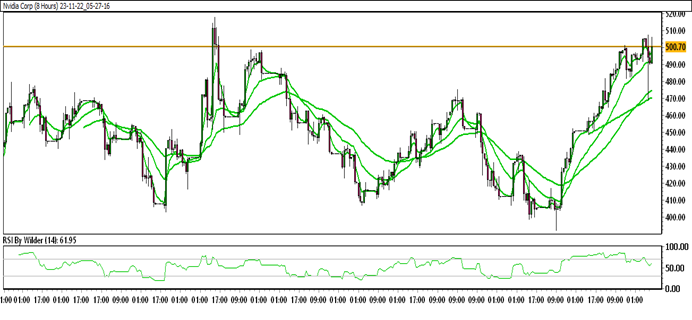

NVIDIA TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

Nvidia is currently trading within a up channel.

Nvidia is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in buying zone, while the Stochastic oscillator suggests neutral trend.

Immediate Resistance level: 501.43

Immediate support level: 490.11

HOW TO TRADE NVIDIA

After a notable surge, NVidia’s stock experienced a decline and entered a consolidation phase. Subsequently, it formed a double-bottom pattern, leading to a renewed upward movement in its price. Currently, Nvidia is trading near a crucial resistance zone, and a breakthrough in this zone could potentially pave the way for further upward momentum.

TRADE SUGGESTION- STOP BUY – 504.91, TAKE PROFIT AT- 520.14, SL AT- 496.64.