NZD/USD sits near the top end of its weekly range, situated in the mid-0.6200s, in anticipation of the US Producer Price Index (PPI).

FUNDAMENTAL OVERVIEW:

- For the second consecutive day, NZD/USD advances, propelled by various factors.

- Optimism regarding additional stimulus from China bolsters antipodean currencies, including the Kiwi.

- Uncertainty surrounding Fed rates keeps USD bulls on the defensive, providing tailwinds for the pair.

Extending its upward momentum, the NZD/USD pair continues to strengthen after rebounding from the weekly low below 0.6200. In the first half of the European session on Friday, spot prices maintain modest intraday gains, hovering around the mid-0.6200s and approaching the upper limit of the weekly range.

China’s National Bureau of Statistics revealed that consumer prices continued to experience deflation for the third consecutive month in December. Additionally, the Producer Price Index (PPI), reflecting factory gate costs, registered a 15th consecutive monthly decline. These prompt speculations of further government stimulus, offering a slight boost to antipodean currencies, including the New Zealand Dollar (NZD).

Given the mixed fundamental conditions and the NZD/USD pair’s recent consolidation within a range over the past week, it is advisable to wait for robust follow-through buying signals before considering new bullish positions. Traders are currently monitoring the upcoming release of the US Producer Price Index (PPI).

NZD/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

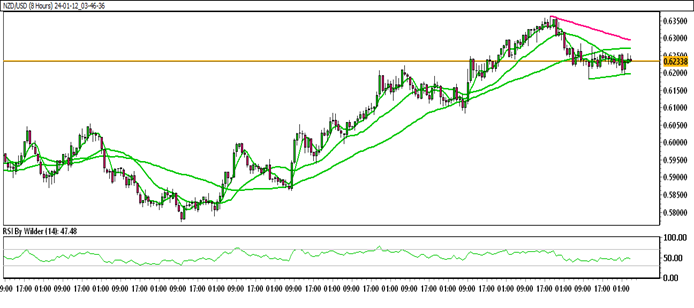

NZD/USD is currently trading within an up channel.

NZD/USD is positioned above 5&20 the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Neutral trend.

Immediate Resistance level: 0.6251

Immediate support level: 0.6196

HOW TO TRADE NZD/USD

Commencing with an upward channel and exhibiting a structure of higher highs, NZD/USD is presently retracing slightly and trading within a range. A potential further upside can be anticipated if the current range is breached to the upside.

TRADE SUGGESTION- STOP BUY– 0.6263, TAKE PROFIT AT- 0.6351, SL AT- 0.6208.