Oil stabilizes as investors monitor developments in the Red Sea.

FUNDAMENTAL OVERVIEW:

Wednesday saw a stabilization in oil prices following robust gains the day before. Investors kept a close eye on developments in the Red Sea, observing major shippers resuming passage through the trade route despite ongoing attacks and heightened tensions in the broader Middle East.

The benchmarks closed with a gain of over 2% in the last session due to renewed attacks on ships in the Red Sea, raising concerns about potential shipping disruptions. Additionally, expectations of U.S. interest rate cuts, seen as a stimulant for economic growth and increased demand, provided further support to prices.

In the face of assaults by Yemen’s Houthi militia, supported by Iran, major shipping firms like Maersk and France’s CMA CGM were recommencing navigation through the Red Sea. This decision followed the deployment of a multinational task force to the region.

Prices received a boost as the U.S. government concluded contracts to purchase 3 million barrels of oil, intended to replenish the Strategic Petroleum Reserve (SPR) that had been depleted to levels not seen in nearly four decades earlier this year.

Attention has shifted to upcoming U.S. inventory data scheduled for release on Wednesday and Thursday, providing additional insights into the supply situation in the world’s leading fuel consumer.

BRENT CRUDE OIL TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

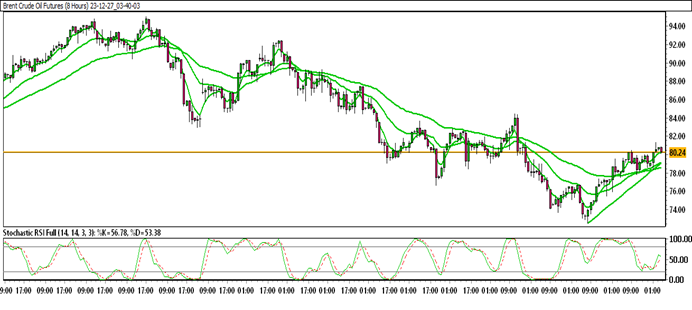

Brent Crude Oil is currently trading within an up channel.

Brent Crude Oil is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 80.86

Immediate support level: 79.07

HOW TO TRADE BRENT CRUDE OIL

After a notable ascent, Brent Crude Oil experienced a subsequent decline, initiating a downward trend marked by lower lows. Currently, it has found support and is exhibiting a strong upward movement. Having breached a significant resistance zone, Brent Crude is undergoing a retest; sustained trading above this key level may indicate potential further upside.

TRADE SUGGESTION- STOP BUY– 81.40, TAKE PROFIT AT- 84.52, SL AT- 79.69.