Oil prices climb as concerns in the Middle East outweigh the increase in US crude inventories.

FUNDAMENTAL OVERVIEW:

On Wednesday, oil prices increased following two consecutive days of declines, driven by a stalemate in Gaza ceasefire negotiations that reignited concerns regarding the security of oil supply from the Middle East. This development overshadowed a larger-than-anticipated build in US crude inventories.

The Oil price retraces after hitting a new five-month peak. Nevertheless, mounting tensions in the Middle East region sustain demand for oil. Israel’s proposal for a ceasefire falls short of meeting several demands from Hamas. However, Hamas indicates it will review the proposal and respond to mediators. Among Hamas’s demands is the withdrawal of Israeli forces and the repatriation of displaced Palestinians resulting from the Gaza conflict.

Meanwhile, market sources citing figures from the American Petroleum Institute indicate that U.S. crude inventories surged by 3.03 million barrels last week. This exceeded analysts’ expectations, who had anticipated an increase of approximately 2.4 million barrels.

CRUDE OIL TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

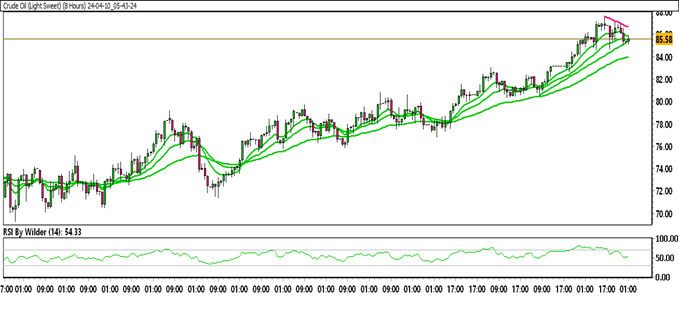

Crude Oil is currently trading within an up channel.

Crude Oil is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Neutral trend.

Immediate Resistance level: 86.19

Immediate support level: 85.09

HOW TO TRADE CRUDE OIL

After experiencing a decline, Crude Oil found support and reversed its direction upwards. Currently, it is trading within an upward channel. However, it has temporarily paused its momentum and is retracing towards a support zone. If this support zone holds, Crude Oil may continue its upward movement.