Powell Expects More Rate Increases, Causing Dow Jones Futures to Drop.

Key Points

1. Dow Jones Futures Fall Ahead of Powell’s Testimony

Ahead of Federal Reserve Chair Jerome Powell’s testimony before the House Financial Services Committee, Dow Jones futures encountered a decline on Wednesday morning. Investors are eagerly awaiting insights into the future of monetary policy. Additionally, Barclays downgraded Tesla stock, adding to the market’s cautious sentiment.

2. Weak Revenue Reports Impact Tesla, FedEx, and Winnebago

Following disappointing revenue results for the most recent quarter, FedEx shares experienced a decline of 2.4%. Similarly, Winnebago shares fell by more than 5% after the motorhome manufacturer failed to meet revenue projections for the third quarter. These developments highlight the influence of financial performance on stock prices and investor sentiment.

3. Powell’s Remarks on Rate Increases and Market Expectations

In his prepared remarks on Wednesday, Powell emphasized the potential impact of interest rate hikes on reducing inflation. He stated that “nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.” Investor expectations, as indicated by the CME Fed Watch Tool, now suggest a close to 77% chance of a quarter-point rate increase at the Fed’s July meeting. This represents an increase from the 60% probability recorded a week earlier.

4. Recent Performance of Dow Jones, Nasdaq Composite, and S&P 500

The market experienced a second consecutive day of losses as the Dow Jones Industrial Average dropped by 116 points, equivalent to 0.34%. On the previous trading day, the Dow Jones fell by 245.25 points or 0.72%. Similarly, the Nasdaq Composite saw a decline of 0.16%, while the S&P 500 dropped by 0.47%. These movements highlight the current volatility and uncertainty in the market.

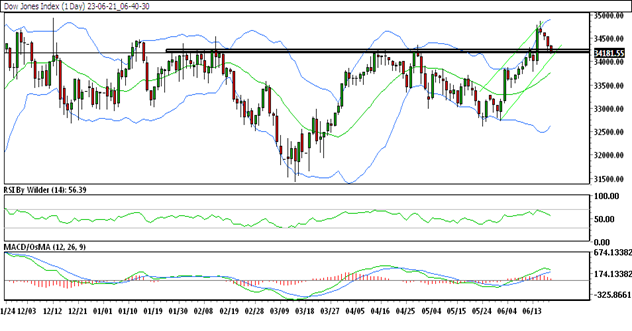

Dow Jones Technical Analysis

Daily Chart Overview

The Dow Jones Industrial Average is currently trading within a downward channel, indicating the prevailing market trend. Furthermore, it remains positioned above both the 20-day and 50-day Simple Moving Averages (SMA), which suggests overall market stability. The Relative Strength Index (RSI) indicates a buying zone, reflecting bullish sentiment. However, the Stochastic oscillator implies a potential downward trend.

Support and Resistance Levels

- Immediate Resistance: 34,372.79

- Immediate Support: 34,197.91

Trading Strategy for Dow Jones

After a strong upward movement, Dow Jones formed an inverted hammer pattern, resulting in a reversal and subsequent downward trend. Currently, the index is trading lower and has breached the previous day’s low. It is currently situated at a support level. However, if this support level is successfully broken, further decline is expected.

Trade Suggestion:

- Sell at 34,210.31

- Target at 34,015.92

- Stop Loss at 34,379.62

Stay updated on the latest developments in the Dow Jones and make informed trading decisions.