XAG/USD regains ground above the mid-$22.00s, approaching the weekly high.

FUNDAMENTAL OVERVIEW:

- Silver sees increased buyer interest for the second consecutive day, edging closer to the weekly peak.

- Exercise caution due to the technical setup, with a descending trend-line obstacle from the December high potentially limiting substantial gains.

On Wednesday, Silver (XAG/USD) continued its upward momentum for the second consecutive day, bouncing back from recent lows near $21.95-$21.90 observed earlier this week. The precious metal extends its intraday gains during the first half of the European session, reaching the upper limit of the weekly range around the $22.60-$22.65 zone in the final hour.

Wednesday sees an uptick in silver prices as they engage in a counter-trend rally, resiliently holding above the crucial support range between $22.00 and $21.88. This upward movement persists despite the obstacles presented by stable U.S. Treasury yields and a strong U.S. Dollar.

Current U.S. economic data is influencing market outlooks, tempering expectations for immediate Federal Reserve rate cuts. Upcoming crucial reports, including the U.S. Flash Manufacturing PMI and GDP figures, will play a vital role in determining the immediate trajectory of silver. The adjustment in rate cut expectations is placing some pressure on silver, yet it is countered by the resilient performance of the U.S. economy.

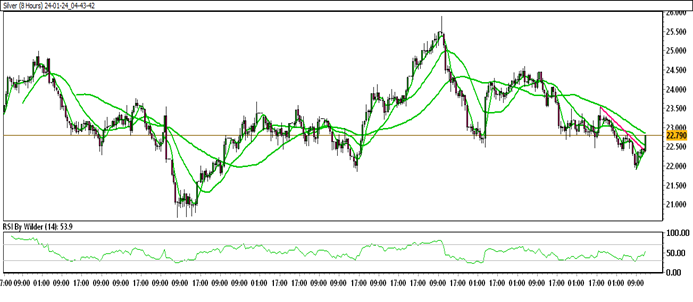

SILVER TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Silver is currently trading within a down channel.

Silver is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 22.81

Immediate support level: 22.08

HOW TO TRADE SILVER

After a significant decline, silver has discovered support and is now rebounding. Currently, it has surpassed the previous day’s levels and is approaching a crucial resistance point. If this level is breached, there could be further upside potential.

TRADE SUGGESTION- STOP BUY– 22.90, TAKE PROFIT AT- 23.79, SL AT- 22.38.