Bulls continue to dominate XAG/USD, maintaining control near the mid-$24.00s, marking a three-week high.

FUNDAMENTAL OVERVIEW:

- Silver registers its fourth consecutive daily gain, reaching a nearly three-week high on Friday.

- The current technical configuration favors bullish sentiment, suggesting potential for further upward movement.

Silver (XAG/USD) prices are influenced by the weakened US dollar and declining Treasury yields, mirroring broader economic patterns and expectations regarding the Federal Reserve’s monetary policy trajectory. The recent 0.1% depreciation of the dollar against major currencies has enhanced the attractiveness of silver for a wider investor base, contributing to its valuation in the global market.

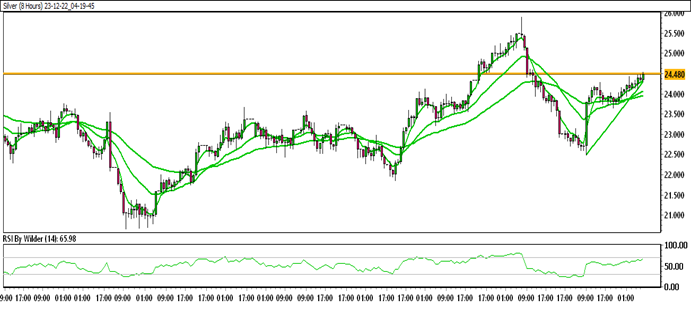

Silver (XAG/USD) continues its upward momentum for the fourth consecutive day on Friday, trading in the vicinity of the $24.45-$24.50 range. This marks a nearly three-week high observed during the initial part of the European session.

looking the broader perspective, the recent surge, starting from an ascending trend-line support established over several months, coupled with a subsequent breakthrough above the 200-day Simple Moving Average (SMA) and the significant $24.00 round figure, has acted as a new catalyst for bullish traders.

Additionally, indicators on the daily chart are showing positive momentum, reinforcing the potential for a continuation of the upward trend established over the past two weeks.

SILVER TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Silver is currently trading within an up channel.

Silver is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a positive trend.

Immediate Resistance level: 24.60

Immediate support level: 24.15

HOW TO TRADE SILVER

After a substantial rise, silver retraced and established a bullish engulfing pattern at the 61.8% Fibonacci zone, prompting an upward trend. Currently, silver has breached a key resistance level and is positioned on the upside. Any corrective pullback could be perceived as a buying opportunity around the $24.00 round figure.