XAG/USD remains steady below $30.00, supported by positive market sentiment

FUNDAMENTAL OVERVIEW:

- Silver prices are consolidating near the $30.00 level with a positive outlook.

- Increasing tensions in the Middle East could bolster the safe-haven appeal of silver.

- Additionally, growing anticipation of a Federal Reserve rate cut in September supports the non-yielding metal.

Silver prices (XAG/USD) remain steady at approximately $29.90 per troy ounce during the Asian session on Monday. Escalating geopolitical tensions in the Middle East drive the positive market sentiment towards safe-haven assets.

Hamas has rejected Israel’s new terms in the ceasefire negotiations taking place in Egypt, demanding that Israel adhere to the conditions set by US President Joe Biden and the UN Security Council, according to Al Jazeera reports.

Non-yielding assets such as silver are gaining traction as the likelihood of a rate cut by the US Federal Reserve in September increases. At the Jackson Hole Symposium on Friday, Fed Chairman Jerome Powell remarked “The time has come for policy to adjust.”

Traders await Friday’s Core PCE inflation data, which is crucial for upcoming Fed rate decisions. Powell’s comments have positively impacted silver market sentiment.

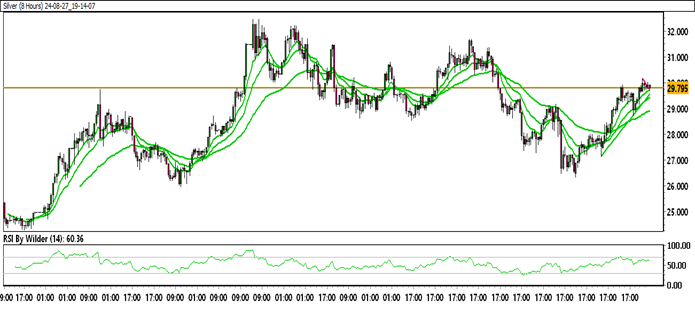

SILVER TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Silver is currently trading within an up channel.

Silver is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 29.97

Immediate support level: 29.37

HOW TO TRADE SILVER

Silver (XAG/USD) is trading above the 50-day moving average at $29.23 and a key pivot point at $29.50, with these levels serving as notable support. The current price action suggests that if silver surpasses the upcoming key resistance level, it could see further gains.