S&P 500 Experiences Decline at the Start of Final Trading Week in June.

Examining the Market Rise Potential for the Last Week of June

In the opening of the last trading week of June, the S&P 500 faced a minor decline, leading Wall Street to assess whether the market’s upward momentum could gain further traction.

The S&P 500 saw a slight dip of approximately 0.1%.

Analysis by Keith Lerner, Co-Chief Investment Officer at Truest

Keith Lerner, co-chief investment officer at Truest, observed that there was a bit of cautiousness following the previous week’s decline in many sectors. Additionally, some investors may be adjusting their investment portfolios as the quarter comes to an end.

Walgreens Boots Alliance Highlights the Economic Indicators and Company Profits

During the final week of June, Walgreens Boots Alliance stood out as one of the few companies releasing economic indicators and profit reports.

European Market Tensions After Russian Uprising

Following a brief military uprising by a private group in Russia over the weekend, traders are closely monitoring the situation in Europe. The uncertainty surrounding the scenario may contribute to a tense market atmosphere.

Tesla Faces Downgrade by Goldman Sachs

Tesla, the electric vehicle manufacturer, experienced a 1.9% decline in its shares after Goldman Sachs downgraded its rating from “buy” to “neutral.” Goldman cited the challenging pricing environment for electric vehicles as a justification for the downgrade, considering the recent surge in Tesla’s stock price.

Moderna Receives Upgrade from UBS

Moderna, the pharmaceutical company, witnessed a 2.5% increase in its stock price following an upgrade to “buy” from “neutral” by UBS. The bank believes that the current valuation of the stock does not adequately reflect the potential gains from future vaccines. UBS adjusted its price target from $221 to $191, indicating a projected 61% increase from the previous Friday’s closing price.

Minimal Changes in the Stock Market to Begin the Last Week of June

The final week of trading in June, as well as the first half of 2023, commenced with minimal fluctuations in the stock market.

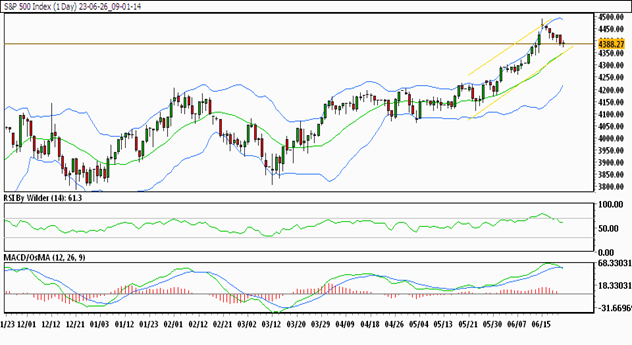

Technical Analysis of S&P 500 Daily Chart

S&P 500 Trading Patterns

The S&P 500 is currently trading within an upward channel.

Key Moving Averages

The S&P 500 remains above its 20-day and 50-day Simple Moving Averages (SMA).

Indicators’ Insights

The Relative Strength Index (RSI) suggests bullishness as it resides in the buying zone, while the Stochastic indicator indicates a downward trend.

Support and Resistance Levels

The immediate resistance level for the S&P 500 is at 4401.71, whereas the immediate support level stands at 4382.23.

Strategies for Trading the S&P 500 This Week

Price Action Analysis

The price of the S&P 500 turned negative after a rapid surge, forming an inverted hammer pattern. Presently, the price is situated within a support zone, and there is a possibility of further decline if this zone is breached.

Trade Suggestion

To capitalize on the potential decline, a trade suggestion would be to sell at 4379.84, set a target at 4345.81, and maintain a stop loss at 4410.09.