Stock futures rise as Wall Street anticipates the S&P 500 to extend its gains and establish a new record high.

FUNDAMENTAL OVERVIEW:

On Monday, stock futures increased as investors aimed to capitalize on the S&P 500’s recently achieved all-time high on Friday.

Futures tied to the S&P 500 index gained 0.4%.

Stocks made a strong comeback on Friday, rebounding from earlier losses in the week. The S&P 500 surpassed both its intraday and closing records from January 2022, concluding the day at 4,839.81. This notable gain officially confirmed that Wall Street is in a bull market that commenced in October 2022.

The resilience of Wall Street appears contingent on the U.S. central bank achieving a soft landing, where the economy cools without slipping into a recession. Investors are anticipating a sequence of benchmark interest rate reductions starting in March, although there is less certainty about the realization of the initial cut.

Investors will be keenly monitoring a range of economic reports scheduled for release this week, with Thursday’s gross domestic product data and Friday’s personal consumption expenditures prices being particularly significant. These reports have the potential to offer insights into how central bank policymakers perceive the trajectory of monetary policy.

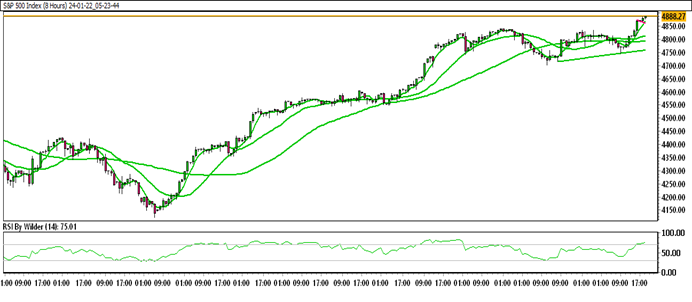

S&P 500 TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

S&P 500 is currently trading within an up channel.

The S&P 500 is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 4895.32

Immediate support level: 4845.00

HOW TO TRADE S&P 500

The S&P 500 has initiated an upward movement, exhibiting a pattern of higher highs. Currently, it has surpassed the previous day’s high and is trading at an elevated level. The expectation is for the S&P 500 to maintain this upward trajectory unless a reversal occurs.

TRADE SUGGESTION- Limit Buy– 4797.33, TAKE PROFIT AT- 4895.32, SL AT- 4741.72.