The benchmark S&P 500 futures are moving up as it approaches its best week since March.

With the Federal Reserve pausing rate rises, as investors had hoped, and positive inflation data, S&P 500 futures edged up on Friday as Wall Street wrapped up a big week.

Futures for the S&P 500 increased by around 0.2%.

The S&P 500 is up almost 3% for the week, which is its strongest showing since March.

The S&P 500 is experiencing its first five-week winning streak since November 2021.

Participants in the market will be keeping an eye out for consumer sentiment data on Friday morning.

Given the projected quarterly rebalancing of some indexes and options expirations, Friday’s session is likely to be volatile. The so-called quadruple witching can increase trading volume and market volatility. According to the Stock Trader’s Almanack, expiry week frequently has a tendency to be higher in bull markets and lower in down markets.

Governor of the Federal Reserve Christopher Waller said on Friday that the institution would not give up on attempts to lower inflation.

In prepared remarks for a speech in Oslo, Norway, Waller said, “The Fed’s job is to use monetary policy to achieve its dual mandate, and right now that means raising rates to fight inflation.”

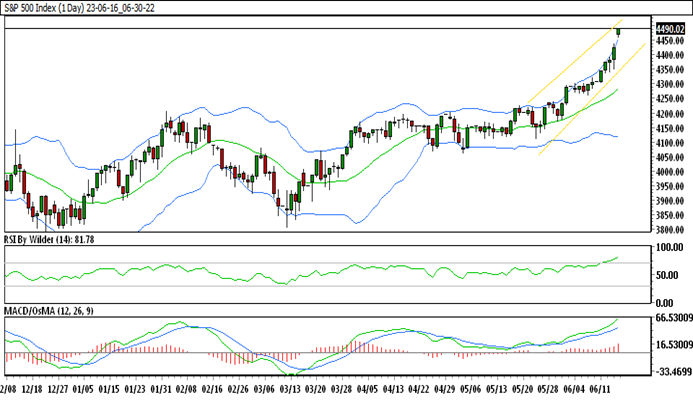

S&P 500 TECHNICAL ANALYSIS DAILY CHART:

S&P 500 is currently trading in the up channel.

S&P 500 is currently trading above all SMA.

RSI is in the overbought zone which suggests bearishness and Stochastic is suggesting an up trend.

Immediate resistance is at 4448.68 & its immediate support level is 4439.52

HOW TO TRADE S&P 500 IN THIS WEEK

S&P 500 is currently moving higher; it has broken through its previous day’s high and is trading in a key zone. If the price remains above the previous day’s high, then only upward potential will only continue. The market has moved without any correction, and the RSI is also in an overbought zone, so if nothing changes from here, we should expect a price correction as well.