As CPI report, investors in the S&P 500 Index brace for its substantial influence on market dynamics and the potential for shifts in Federal Reserve policies.

FUNDAMENTAL OVERVIEW:

Investors adopted a cautious approach, leading to slightly lower U.S. stock futures, as they awaited the release of January inflation data.

The market’s primary attention is on the January update of the U.S. Consumer Price Index, a crucial gauge of inflation in the world’s largest economy. While overall annual inflation is anticipated to decrease in January, the persistence of elevated prices for services may reinforce the argument for the Federal Reserve to delay potential interest rate cuts.

The S&P 500 futures contract had shed 21 points, or a decline of 0.4%.

The focus of the day is on the upcoming release of the Consumer Price Index (CPI) report scheduled for 13:30 GMT. Investors are preparing to scrutinize this vital data for indications of inflation trends, crucial for predicting potential shifts in Federal Reserve policies. Expectations are for a 0.2% month-over-month increase in headline inflation and a 2.9% year-over-year rise. The core CPI, excluding volatile food and energy prices, is anticipated to show a 0.3% monthly increase and a 3.7% annual rise.

S&P 500 Index futures exhibit a decline on Tuesday following the confirmation of yesterday’s notable and potentially bearish closing price reversal top. While this formation doesn’t alter the overall trend, it may prompt a brief 2-to-3-day pullback.

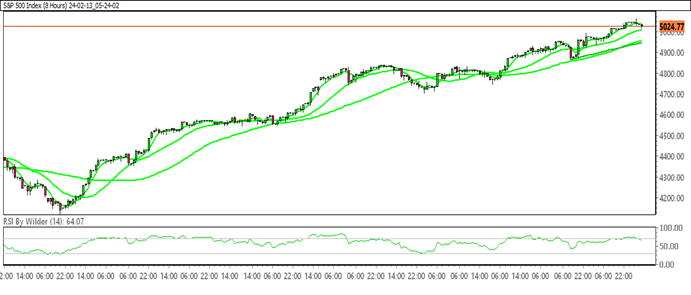

S&P 500 TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

S&P 500 is trading within an up channel.

The S&P 500 is positioned above 20&50 in the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Neutral trend.

Immediate Resistance level: 5046.16

Immediate support level: 4957.99

HOW TO TRADE S&P 500

The S&P 500 has been consistently ascending with a pattern of higher highs. Presently, it has paused its upward movement and is attempting a minor correction. The current trend indicates an upward trajectory, suggesting a potential opportunity to initiate long positions during specific pullbacks.

TRADE SUGGESTION- LIMIT BUY– 4964.56, TAKE PROFIT AT- 5036.85, SL AT- 4923.97.