Unleash the Power of Stocks Trading

Welcome to the world of stocks trading – where your money works for you to unlock untapped financial opportunities! Are you ready to dive into the exciting world of global markets? Look no further! With the ability to trade stocks from North American, European, and Asia Pacific markets, you have the power to go long or short on popular stocks without the hassle of physical delivery or shorting restrictions.

Riding the Unicorns

Stocks trading allows you to ride the waves of market volatility, going long (buying) or short (selling) on popular stocks. Whether the market is on an upward trajectory or experiencing a dip, you have the potential to capitalize on both scenarios, maximizing your profit potential.

Global Market Access

Diversify your trading portfolio by accessing stocks from major markets across North America, Europe, and Asia Pacific. By trading stocks from different regions, you can take advantage of varying market trends and seize opportunities regardless of geographical boundaries.

0.1% COMMISSION

Trade in the popular companies including amazon, Facebook, Unilever with lowest brokerage commission

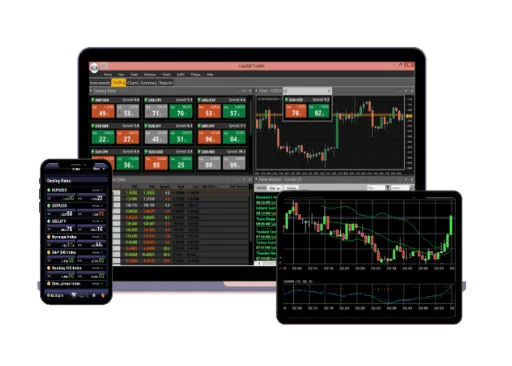

BEST TRADING PLATFORMS

Secure and Fast online Trading Stocks using our web platform or mobile and tablet apps.

COMPETITIVE PRICES

We offer the most accurate and best price as we source our prices from multiple and different sources

EXCEPTIONAL-LEVERAGE

Get full exposure to the market with a small initial deposit. However, remember that leverage is associated with increased risk.

OPEN LONG AND SHORT POSITIONS

When trading in CFDs, you can open short positions, and increase your earning potential from falling markets.

DIRECT MARKET ACCESS

Increased control and liquidity when interacting with order books of major exchanges. See frequently asked questions.

Navigating the Stocks Trading Landscape

The stock market operates on the principle of buying low and selling high. Whether you’re looking for short-term gains or long-term investments, stocks trading empowers you to execute various trading strategies tailored to your financial goals.

Investing in stocks online through Contract for Difference (CFD) instruments offers you the opportunity to trade on the price movements of various shares without actually owning them. At Capital Street FX, we provide access to CFD shares of renowned brands like Apple, Google, Facebook, and Netflix, along with a wide range of other financial trading shares.

BASIC

$100

Leverage: 2500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.5

Open Orders: 300

CLASSIC

$200

Leverage: 3000 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 2.0

Open Orders: 300

PROFESSIONAL

$200

Leverage: 3500 Times

Spreads Types: Fixed/Variable

Spreads from (pips): 1.5

Open Orders: 300

VIP

$10,000

Leverage: 100 (Request For More)

Spreads Types: Fixed/Variable

Spreads from (pips): 0.1

Open Orders: 400

Stocks desktop Trader →

Our most popular platform, Capital Trader is designed with a wide range of investors and traders in mind.

Stocks WEB TRADER LITE →

The most difficult and testing circumstances require a platform that provides clients critical market access

Stocks Web Trader →

Application is a lightweight that can be accessed from anywhere using an internet connection and computer.

Stocks Mobile Trader→

Introducing Mobile Trader, a complete mobile trading solution for the Android and iOS platforms

In simple terms the frequently buying and selling of stocks or shares of a company in order to take profit from price fluctuation is called stock trading. Stock trader falls in two categories: first those who buy and sell more than ten share a month and hold the position for more than one day are called active traders and second who buy, sell shares and closing their position on the same day are called day traders or intraday trading.

How much share a beginner should buy depends on the risk appetite of that person, however, as a rule of thumb an investor should not risk more than 2% of the total account value and dividing that value with stop loss value in points will give you total numbers of stocks you can buy. The 2% rule is not fixed but depends on the risk appetite of the investor.

Like any other businesses, stock trading can also be considered as business. Trading in the stock market is a way to make extra income or it can be a full-time business. Like in any other business, profit generated by the business is taxable the same applies with income generated from trading stock market. like every business, trading stock market also comes with its own set of risks and advantages.

With the development in technology, investing in the stock market have become very convenient. A person has to open an investing account with a broker and he is ready to invest in stock market. There are two types of approach for investing in the stock market i.e. passive investor and active investor. Passive investors are those who like someone well trained to manage their money for them and active investors are those who manage their money by themselves. Both the approach comes with their own advantages and drawbacks.

There are many types of charts but most of the technical analyst prefer candlestick chart because of its efficiency. Look for the trend in the market-its either going up or downside. After identifying the trend look for support and resistance levels. Prices often change their direction at these support and resistance levels. The movement of price can be anticipated with the help of different candlestick patterns. Capital Street also provides the most popular indicators, which can help you to study the charts with greater efficiency.

Liquidity means the degree of ease to which an asset or security can be bought or sold in a market without affecting the price in the market or in other words, how easily it can be converted into cash. For day traders, liquidity is a very important factor in formulating a trading strategy as well as in executing a stop-loss order. A trader can quickly analyze liquidity by looking at bid-ask spread or by checking its daily traded volume that is the number of shares being traded each day. The float also affects the liquidity of a stock as it refers to how many shares are available for the public to trade.