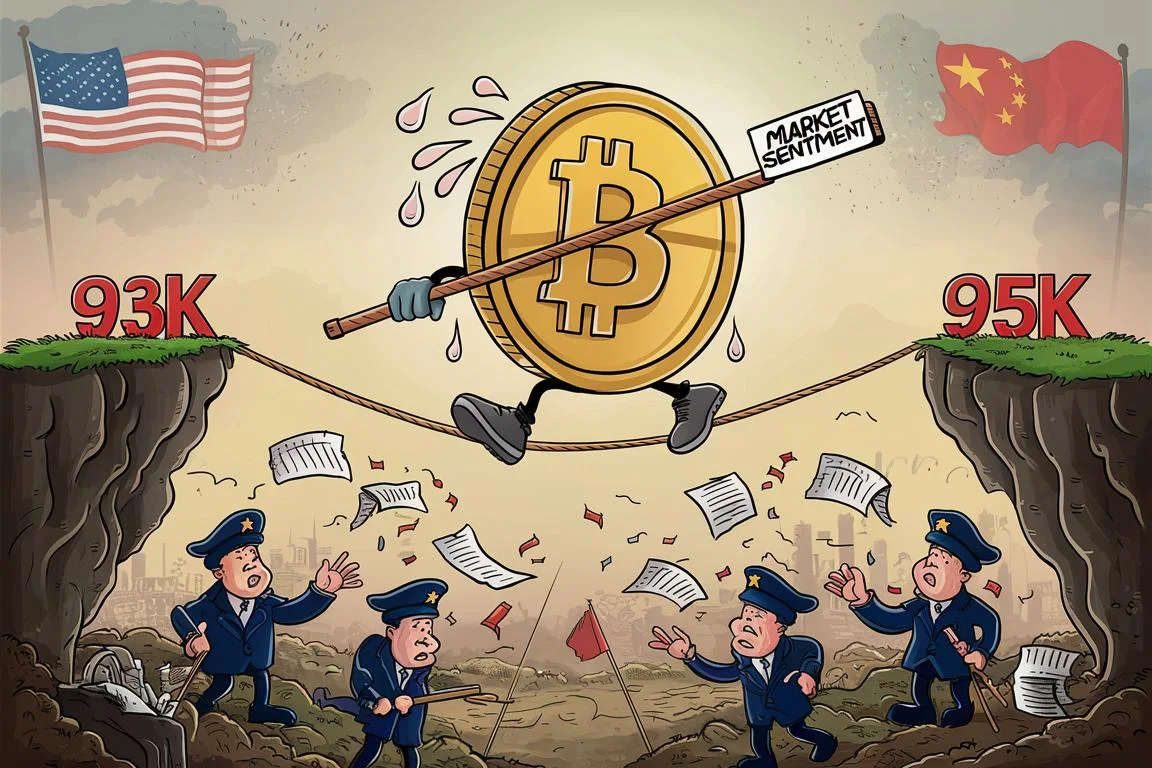

Bitcoin continues to trade near $94,000, with overall market sentiment weighed down by concerns over U.S. trade tariffs and growing economic uncertainty. The broader cryptocurrency market remains subdued, showing limited movement across key assets like Bitcoin, Ethereum, XRP, and Dogecoin. Lingering risks and a lack of new catalysts have contributed to narrow trading ranges.

KEY HIGHLIGHTS

- Bitcoin Holds Near $94K Amid Trade Tensions, Market Caution

- Ripple Retreats Toward $2.00 As Bullish Momentum Weakens Further

- Ethereum Faces Selling Pressure After Rejection Below $1,880 Resistance

- Dogecoin Declines Below $0.1700 Following Failed Breakout Attempt

Bitcoin (BTC/USD)

Price Action: Consolidation Near $94K Amid Tariff Concerns

Bitcoin traded lower on Tuesday, remaining within a narrow range due to heightened caution driven by rising U.S.-China trade tensions. The digital asset stayed within the $90,000 to $97,000 range, a band it has maintained for the past week, as bullish momentum from late April faded.

Key market drivers:

- U.S. tariff threats escalating trade war concerns

- Slowing global economic outlook

- Absence of fresh bullish triggers

Technical Overview

Moving Averages

Exponential Moving Averages:

- MA 10: 94,375.18 | Bearish crossover

- MA 20: 92,450.25 | Bullish crossover

- MA 50: 89,636.27 | Bullish crossover

Simple Moving Averages:

- MA 10: 94,981.29 | Bearish crossover

- MA 20: 92,384.96 | Bullish crossover

- MA 50: 87,112.56 | Bullish crossover

Indicators

- RSI: 58.22 | Buy Zone | Bullish

- Stochastic Oscillator: 59.26 | Buy Zone | Neutral

Resistance and Support Levels

- Resistance 1: 96,352.96

- Resistance 2: 101,420.45

- Support 1: 79,948.01

- Support 2: 74,880.52

Market Sentiment

- Overall Sentiment: Bullish

- Market Direction: Buy

Trade Suggestion

- Entry (Limit Buy): 90,157

- Take Profit: 99,445

- Stop Loss: 85,967

Ripple (XRP/USD)

Price Action: Bullish Breakout Delayed as Risks Persist

Ripple (XRP) is showing signs of a gradual decline, trading near $2.09. Despite a recent attempt at recovery, the price remains below key moving averages and a descending trendline from January.

Critical observations:

- Support at $2.00 remains vital for bullish continuation

- Resistance levels capped recent recovery efforts

- A breakout above key exponential MAs is required for renewed bullish momentum

Technical Overview

Moving Averages

Exponential Moving Averages:

- MA 10: 2.1664 | Bearish crossover

- MA 20: 2.1653 | Bearish crossover

- MA 50: 2.1959 | Bearish crossover

Simple Moving Averages:

- MA 10: 2.1976 | Bearish crossover

- MA 20: 2.1681 | Bearish crossover

- MA 50: 2.1742 | Bearish crossover

Indicators

- RSI: 43.08 | Neutral Zone | Neutral

- Stochastic Oscillator: 19.96 | Sell Zone | Neutral

Resistance and Support Levels

- Resistance 1: 2.3417

- Resistance 2: 2.5181

- Support 1: 1.7707

- Support 2: 1.5943

Market Sentiment

- Overall Sentiment: Bearish

- Market Direction: Sell

Trade Suggestion

- Entry (Limit Sell): 2.14

- Take Profit: 2.04

- Stop Loss: 2.22

Ethereum (ETH/USD)

Price Action: Downside Risks Mount as Bears Regain Control

Ethereum is facing increasing downside pressure after failing to break above the $1,880 resistance level. The asset is now trading below $1,800 and the 100-hour SMA, with a risk of further declines.

Key takeaways:

- Resistance around $1,800 continues to limit gains

- Support near $1,750 is the key level to watch for further bearish pressure

- A move below $1,750 may trigger a deeper decline toward $1,720

Technical Overview

Moving Averages

Exponential Moving Averages:

- MA 10: 1,797.92 | Bearish crossover

- MA 20: 1,772.78 | Bullish crossover

- MA 50: 1,851.63 | Bearish crossover

Simple Moving Averages:

- MA 10: 1,810.65 | Bearish crossover

- MA 20: 1,749.38 | Bullish crossover

- MA 50: 1,779.36 | Bearish crossover

Indicators

- RSI: 50.14 | Buy Zone | Bullish

- Stochastic Oscillator: 66.19 | Buy Zone | Neutral

Resistance and Support Levels

- Resistance 1: 1,928.82

- Resistance 2: 2,063.15

- Support 1: 1,493.96

- Support 2: 1,359.63

Market Sentiment

- Overall Sentiment: Bearish

- Market Direction: Sell

Trade Suggestion

- Entry (Limit Sell): 1,793.6

- Take Profit: 1,675.4

- Stop Loss: 1,885.2

Dogecoin (DOGE/USD)

Price Action: Pullback Continues After Failing Resistance

Dogecoin has slipped from recent highs and is now trading below $0.1700, facing renewed bearish momentum. After failing to breach $0.1880, DOGE has tested the sub-$0.1680 zone.

Key developments:

- Price below $0.1700 and 100-hour SMA indicates downward momentum

- Rejection at $0.1700 could lead to another leg lower

- Support at $0.1408 is the next key level to monitor

Technical Overview

Moving Averages

Exponential Moving Averages:

- MA 10: 0.1729 | Bearish crossover

- MA 20: 0.1720 | Bearish crossover

- MA 50: 0.1780 | Bearish crossover

Simple Moving Averages:

- MA 10: 0.1750 | Bearish crossover

- MA 20: 0.1719 | Bearish crossover

- MA 50: 0.1691 | Bearish crossover

Indicators

- RSI: 44.44 | Neutral Zone | Neutral

- Stochastic Oscillator: 27.15 | Sell Zone | Neutral

Resistance and Support Levels

- Resistance 1: 0.1892

- Resistance 2: 0.2041

- Support 1: 0.1408

- Support 2: 0.1259

Market Sentiment

- Overall Sentiment: Bearish

- Market Direction: Sell

Trade Suggestion

- Entry (Limit Sell): 0.171

- Take Profit: 0.154

- Stop Loss: 0.186

Broader Market Snapshot

- Bitcoin: Down 0.82% at 93,947

- Ethereum: Down 2.63% at 1,772.23

- Litecoin: Down 1.68% at 81.89

- Solana: Down 1.94% at 143.08

- Dogecoin: Down 2.67% at 0.166

Key Economic Events – May 3, 2025

- Australia Building Approvals (MoM) – April

- Forecast: -1.7%

- Previous: -0.2%

- Release Time: 07:00 (AUD)