Global currency markets opened the new trading week with mixed performance as traders reacted to central bank expectations, inflation data, and risk sentiment ahead of key US data releases, including the ISM Services PMI. Below is a breakdown of the major currency pairs and their current technical and fundamental outlooks.

KEY HIGHLIGHTS

- EUR/USD Holds Above 1.1300 As Dollar Weakness Persists

- GBP/USD Stable Ahead Of Key Bank Of England Decision

- USD/JPY Weakens Slightly Despite Safe-Haven Yen Support Rising

- AUD/USD Rises As April Inflation Beats Market Expectations

EUR/USD: Steady Above 1.1300 Amid Dollar Weakness

The EUR/USD pair maintained strength above the 1.1300 level during European trading hours, supported by a softer US Dollar driven by global trade concerns and anticipation of the Federal Reserve’s policy direction.

Fundamental Highlights

- The pair attracted dip-buying interest despite recent mild selling pressure.

- EUR/USD ended the prior week near 1.1350, almost unchanged from the weekly open.

- US Dollar weakness was attributed to:

- Ongoing global trade tensions.

- Investor caution ahead of the Fed policy meeting.

- Eurozone Data:

- Economic Sentiment Indicator declined to 93.6 (from 95.0).

- Q1 GDP beat expectations at 1.2% YoY and 0.4% QoQ.

- April HICP Inflation printed at 2.2% YoY (vs. 2.1% forecast).

- ECB Commentary:

- Olli Rehn suggested deeper rate cuts may be needed.

- Chief Economist Philip Lane noted flexibility and lowered growth forecasts.

Technical Overview

Moving Averages

- Exponential MA:

- MA 10: 1.1329 | Positive Crossover | Bullish

- MA 20: 1.1267 | Positive Crossover | Bullish

- MA 50: 1.1044 | Positive Crossover | Bullish

- Simple MA:

- MA 10: 1.1348 | Negative Crossover | Bearish

- MA 20: 1.1311 | Positive Crossover | Bullish

- MA 50: 1.0992 | Positive Crossover | Bullish

Indicators

- RSI: 58.22 | Buy Zone | Bullish

- Stochastic Oscillator: 12.50 | Sell Zone | Neutral

Key Levels

- Resistance: R1: 1.1530 | R2: 1.1718

- Support: S1: 1.0923 | S2: 1.0735

Market Sentiment

- Overall Sentiment: Bullish

- Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 1.1219

- Take Profit: 1.1429

- Stop Loss: 1.1098

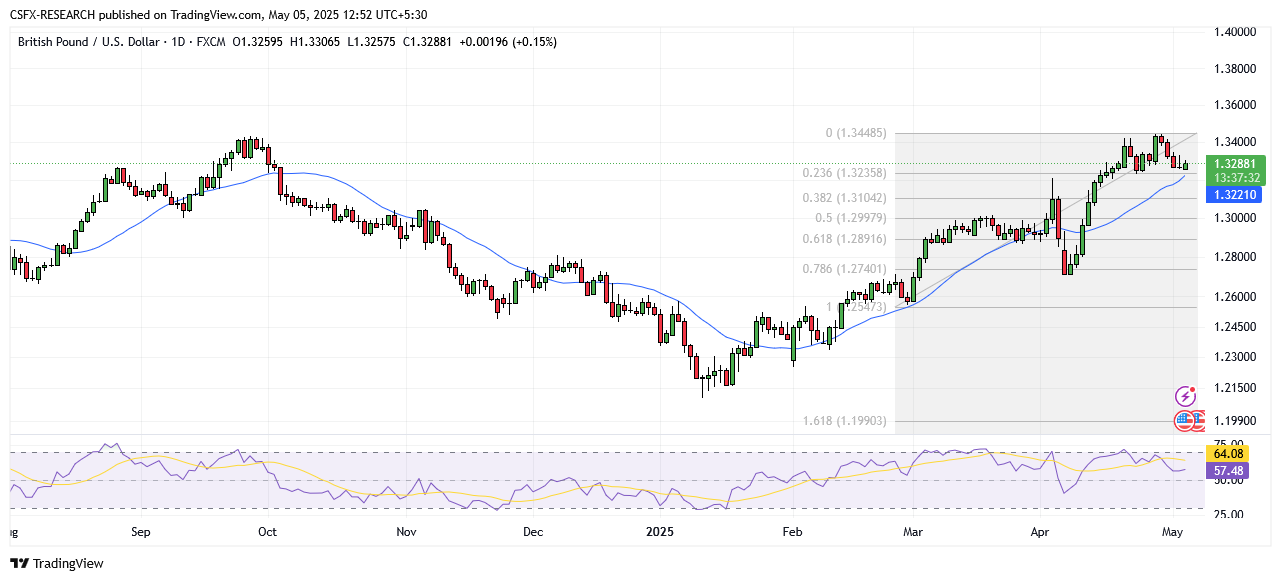

GBP/USD: Sideways Action Ahead of BoE Decision

The GBP/USD pair trades steadily around 1.3260 as investors await the Bank of England’s upcoming monetary policy decision.

Fundamental Highlights

- The pair remains underpinned by broad USD weakness, despite Friday’s strong US NFP report.

- Market still pricing in Fed rate cuts by June, totaling up to 100 bps by year-end.

- US-China trade optimism is weighing on USD safe-haven demand.

- Traders are cautious ahead of:

- BoE’s Thursday Policy Decision – A 25 bps cut is widely expected.

- Fed’s FOMC meeting conclusion on Wednesday.

Technical Overview

Moving Averages

- Exponential MA:

- MA 10: 1.3292 | Negative Crossover | Bearish

- MA 20: 1.3226 | Positive Crossover | Bullish

- MA 50: 1.3040 | Positive Crossover | Bullish

- Simple MA:

- MA 10: 1.3318 | Negative Crossover | Bearish

- MA 20: 1.3220 | Positive Crossover | Bullish

- MA 50: 1.3016 | Positive Crossover | Bullish

Indicators

- RSI: 57.67 | Buy Zone | Bullish

- Stochastic Oscillator: 41.74 | Neutral Zone | Neutral

Key Levels

- Resistance: R1: 1.3439 | R2: 1.3613

- Support: S1: 1.2878 | S2: 1.2704

Market Sentiment

- Overall Sentiment: Bullish

- Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 1.3204

- Take Profit: 1.3384

- Stop Loss: 1.3115

USD/JPY: Yen Holds Firm Amid Cautious Market Mood

USD/JPY edged slightly higher after trimming early losses, though the pair remains capped by broad market caution and persistent USD weakness.

Fundamental Highlights

- The Yen’s strength is supported by:

- Safe-haven demand due to global trade uncertainties.

- Market risk-off sentiment ahead of Fed’s meeting.

- BoJ’s continued dovish stance limits significant JPY upside.

- Investors are likely to stay cautious ahead of key US ISM Services data.

Technical Overview

Moving Averages

- Exponential MA:

- MA 10: 143.7277 | Positive Crossover | Bullish

- MA 20: 144.1661 | Positive Crossover | Bullish

- MA 50: 146.4787 | Negative Crossover | Bearish

- Simple MA:

- MA 10: 143.3746 | Positive Crossover | Bullish

- MA 20: 143.4332 | Positive Crossover | Bullish

- MA 50: 146.7261 | Negative Crossover | Bearish

Indicators

- RSI: 48.08 | Neutral Zone | Neutral

- Stochastic Oscillator: 82.74 | Buy Zone | Neutral

Key Levels

- Resistance: R1: 148.49 | R2: 150.99

- Support: S1: 140.39 | S2: 137.88

Market Sentiment

- Overall Sentiment: Bearish

- Market Direction: Sell

Trade Suggestion

- Entry: Limit Sell at 144.90

- Take Profit: 142.85

- Stop Loss: 146.55

AUD/USD: Supported by Rising Inflation and Political Stability

The Australian Dollar extended gains on Monday, supported by stronger inflation data and political clarity following the federal election.

Fundamental Highlights

- Prime Minister Anthony Albanese’s re-election adds to political stability.

- Economic stimulus pledges support AUD strength.

- Inflation data:

- TD-MI Inflation Gauge rose 0.6% MoM in April.

- YoY inflation accelerated to 3.3%, up from 2.8%.

- Trade sentiment was lifted by:

- China reviewing a US trade proposal.

- US policy uncertainty under Trump’s renewed tariff discussions.

Technical Overview

Moving Averages

- Exponential MA:

- MA 10: 0.6404 | Positive Crossover | Bullish

- MA 20: 0.6365 | Positive Crossover | Bullish

- MA 50: 0.6324 | Positive Crossover | Bullish

- Simple MA:

- MA 10: 0.6403 | Positive Crossover | Bullish

- MA 20: 0.6342 | Positive Crossover | Bullish

- MA 50: 0.6302 | Positive Crossover | Bullish

Indicators

- RSI: 62.06 | Buy Zone | Bullish

- Stochastic Oscillator: 77.21 | Buy Zone | Neutral

Key Levels

- Resistance: R1: 0.6459 | R2: 0.6585

- Support: S1: 0.6050 | S2: 0.5924

Market Sentiment

- Overall Sentiment: Bullish

- Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 0.6429

- Take Profit: 0.6548

- Stop Loss: 0.6368

Other Currency Moves

- USD/CAD: Down 0.05% at 1.3810

- USD/CHF: Down 0.04% at 0.8266

- EUR/GBP: Up 0.7% at 0.8521

- EUR/AUD: Down 0.22% at 1.7488

- AUD/NZD: Down 0.03% at 1.0841

- USD/CNY: Up 0.01% at 7.2706

- AUD/SEK: Up 0.43% at 6.2461

Key Economic Events Today

| Time (GMT) | Country | Event | Forecast | Previous |

|---|---|---|---|---|

| 12:00 | CHF | CPI (MoM) (Apr) | 0.2% | 0.0% |

| 19:15 | USD | S&P Global Services PMI (Apr) | 51.4 | 54.4 |

| 19:30 | USD | ISM Non-Manufacturing PMI (Apr) | 50.2 | 50.8 |