The foreign exchange market remains under pressure as geopolitical tensions, trade disputes, and central bank decisions shape sentiment. The US Dollar’s performance is mixed, with concerns over economic growth and upcoming Federal Reserve policy decisions driving market movements. Meanwhile, the Euro, Pound, and Canadian Dollar face key domestic catalysts that could influence near-term trends.

KEY HIGHLIGHTS

- EUR/USD Stays Below 1.0950 Amid Trade War Concerns.

- GBP/USD Dips Below 1.3000 Despite Limited Downside Pressure.

- USD/CAD Trades Near 1.4300 Before Canadian CPI Release.

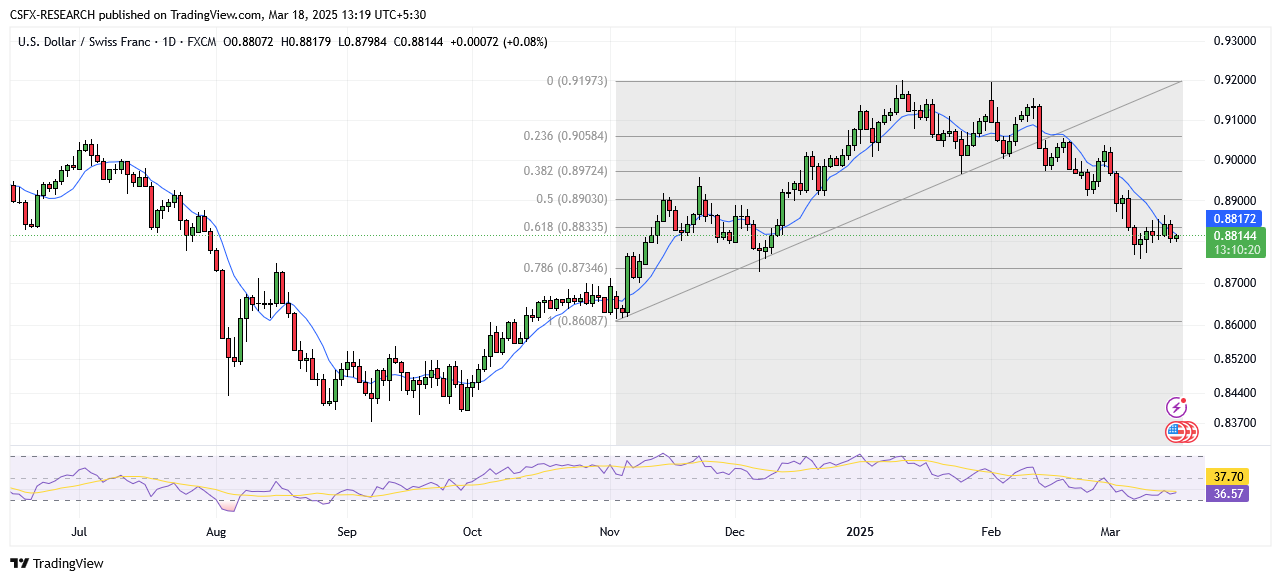

- USD/CHF Remains Flat Around 0.8800 Awaiting Fed Decision.

EUR/USD Analysis

Market Overview

EUR/USD remains below 1.0950, with optimism surrounding a potential German fiscal agreement potentially helping to curb further losses.

During the early Asian session on Tuesday, the pair trades around 1.0915, experiencing modest losses due to escalating trade tensions. US President Donald Trump’s decision to impose additional tariffs on European Union goods, including a proposed 200% levy on European wine and spirits, has heightened tensions. In response, the EU has outlined plans for retaliation, which could pressure the Euro further.

However, losses may be cushioned by a weaker US Dollar amid concerns over a potential economic slowdown in the United States. Additionally, optimism around Germany’s fiscal policy developments might limit losses for the Euro, with expectations that the proposed €500 billion infrastructure fund and debt restructuring agreement will gain approval.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 1.0825 | Bullish

- MA 20: 1.0716 | Bullish

- MA 50: 1.0583 | Bullish

- Simple:

- MA 10: 1.0859 | Bullish

- MA 20: 1.0665 | Bullish

- MA 50: 1.0491 | Bullish

Indicators

- RSI: 70.78 | Buy Zone

- Stochastic Oscillator: 92.23 | Neutral

Resistance & Support Levels

- R1: 1.0493 | R2: 1.0568

- S1: 1.0249 | S2: 1.0174

Trade Suggestion:

- Limit Buy: 1.0721 | Take Profit: 1.0950 | Stop Loss: 1.0596

GBP/USD Analysis

Market Overview

GBP/USD dips below 1.3000, though further losses appear limited as the US Dollar remains under pressure.

During the Asian session on Tuesday, GBP/USD hovers around 1.2970 after recent gains. The pair faces headwinds as the US Dollar attempts to recover losses but remains vulnerable due to economic concerns in the United States. Meanwhile, expectations that the Bank of England (BoE) will hold interest rates steady at its policy meeting on Thursday support the Pound.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 1.2908 | Bullish

- MA 20: 1.2812 | Bullish

- MA 50: 1.2678 | Bullish

- Simple:

- MA 10: 1.2931 | Bullish

- MA 20: 1.2791 | Bullish

- MA 50: 1.2552 | Bullish

Indicators

- RSI: 68.41 | Neutral

- Stochastic Oscillator: 92.76 | Neutral

Resistance & Support Levels

- R1: 1.2691 | R2: 1.2801

- S1: 1.2335 | S2: 1.2225

Trade Suggestion:

- Limit Buy: 1.2826 | Take Profit: 1.3044 | Stop Loss: 1.2705

USD/CAD Analysis

Market Overview

USD/CAD trades with a slight bullish bias near 1.4300, though further upside appears constrained ahead of the Canadian CPI release.

The US Dollar is attempting a modest recovery, supported by repositioning ahead of key central bank events. However, expectations of multiple Federal Reserve rate cuts this year keep significant USD appreciation uncertain. Meanwhile, crude oil prices remain high, providing support for the commodity-linked Canadian Dollar.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 1.4352 | Bearish

- MA 20: 1.4349 | Bearish

- MA 50: 1.4318 | Bearish

- Simple:

- MA 10: 1.4362 | Bearish

- MA 20: 1.4345 | Bearish

- MA 50: 1.4345 | Bearish

Indicators

- RSI: 45.96 | Neutral

- Stochastic Oscillator: 25.27 | Neutral

Resistance & Support Levels

- R1: 1.4715 | R2: 1.4866

- S1: 1.4224 | S2: 1.4073

Trade Suggestion:

- Limit Sell: 1.4352 | Take Profit: 1.4238 | Stop Loss: 1.4446

USD/CHF Analysis

Market Overview

USD/CHF remains stable around 0.8800 as traders await the Federal Reserve and SNB rate decisions.

The US Dollar Index (DXY) edges higher to 103.55, though geopolitical tensions in the Middle East strengthen demand for the Swiss Franc, capping gains for USD/CHF. Market sentiment remains cautious ahead of upcoming monetary policy decisions.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 0.8838 | Bearish

- MA 20: 0.8886 | Bearish

- MA 50: 0.8942 | Bearish

- Simple:

- MA 10: 0.8824 | Bearish

- MA 20: 0.8897 | Bearish

- MA 50: 0.9007 | Bearish

Indicators

- RSI: 36.84 | Neutral

- Stochastic Oscillator: 21.39 | Neutral

Resistance & Support Levels

- R1: 0.9154 | R2: 0.9221

- S1: 0.8937 | S2: 0.8870

Trade Suggestion:

- Limit Sell: 0.8866 | Take Profit: 0.8752 | Stop Loss: 0.8949

Elsewhere in the Forex Market

- AUD/USD: Down 0.04% to 0.6382

- USD/CAD: Up 0.04% to 1.4294

- EUR/GBP: Up 0.03% to 0.8413

- USD/CNY: Down 0.08% to 7.2271

Key Economic Events Today

- (CAD) Core CPI (MoM) (Feb): Previous 0.4% at 18:00

- (CAD) Core CPI (YoY) (Feb): Previous 2.1% at 18:00

- (USD) Industrial Production (YoY) (Feb): Previous 2.00% at 18:45