The forex market remains volatile as investors shift their focus to upcoming PMI data and evolving trade policies. The EUR/USD pair stabilizes near 1.0840 amid concerns over a potential US economic slowdown, while GBP/USD maintains a positive tone due to the Bank of England’s (BoE) hawkish stance. Meanwhile, USD/JPY hovers around 150.00 as weaker Japanese PMI data puts pressure on the yen, and AUD/USD sees a recovery fueled by robust Australian PMI figures.

KEY HIGHLIGHTS

- EUR/USD Rebounds on US Slowdown Concerns, PMI Data Ahead.

- GBP/USD Rises on BoE Hawkishness, Market Awaits PMI Results.

- USD/JPY Steady Near 150.00 Amid Geopolitical Uncertainty.

- AUD/USD Gains Strength After Positive Domestic PMI Figures.

EUR/USD Climbs Toward 1.0850 Amid US Economic Concerns

EUR/USD has rebounded to approximately 1.0850, reversing a three-day decline during Monday’s early Asian session. Concerns over a potential US economic slowdown, driven by trade policies under President Donald Trump, are weighing on the US Dollar, thereby supporting the pair.

Key Factors Influencing EUR/USD:

- US Trade Policy: The White House is revising its tariff strategy ahead of the April 2 implementation. Reports indicate a shift toward reciprocal tariffs on key US trading partners.

- Eurozone Economic Risks: ECB President Christine Lagarde has highlighted downside risks due to ongoing trade disputes.

- Upcoming Data: Investors are closely watching the preliminary March Purchasing Managers Index (PMI) data for the Eurozone, Germany, and the United States, set for release later today.

Technical Overview

- Moving Averages (Exponential)

- MA 10: 1.0840 | Negative Crossover | Bearish

- MA 20: 1.0762 | Positive Crossover | Bullish

- MA 50: 1.0624 | Positive Crossover | Bullish

- RSI (Relative Strength Index): 60.93 | Buy Zone | Bullish

- Stochastic Oscillator: 73.29 | Buy Zone | Neutral

Resistance & Support Levels

- R1: 1.0493 | R2: 1.0568

- S1: 1.0249 | S2: 1.0174

Trade Suggestion:

- Limit Buy: 1.0710

- Take Profit: 1.0919

- Stop Loss: 1.0594

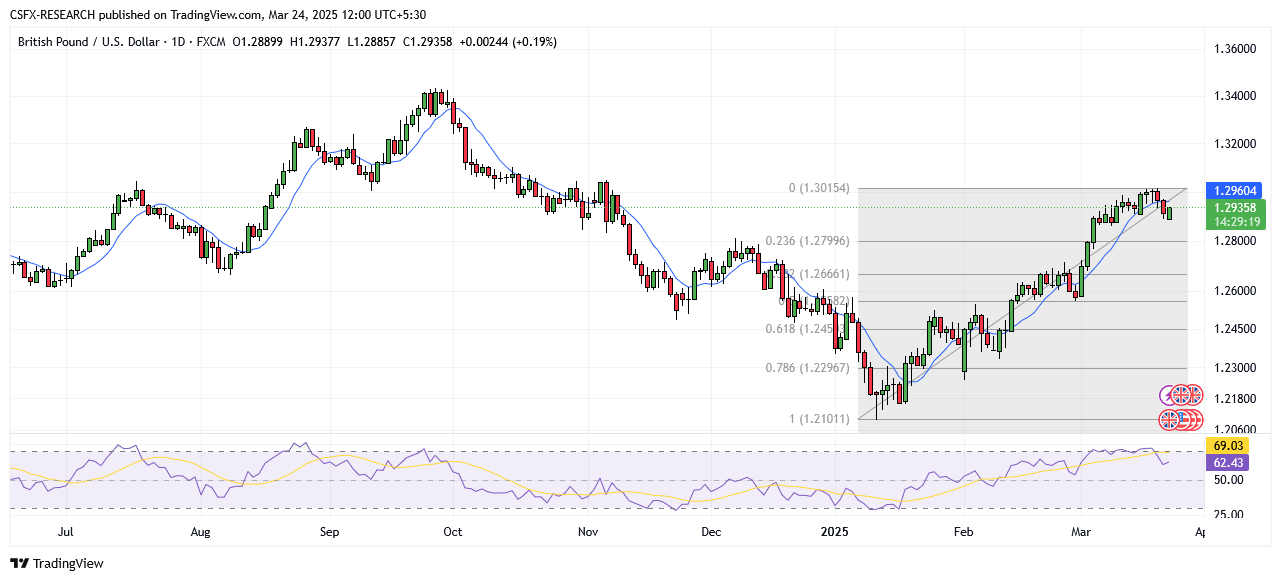

GBP/USD Gains Traction Near 1.2950 as Traders Eye US PMI Data

GBP/USD has edged higher toward 1.2940 in early European trading, supported by a softer US Dollar. Uncertainty surrounding President Trump’s trade policies and concerns over a potential US economic slowdown are keeping the Greenback subdued.

Key Factors Influencing GBP/USD:

- US Tariff Policy: The market remains cautious as Trump prepares to introduce reciprocal tariffs on April 2, targeting key industries.

- UK Economic Uncertainty: The British Pound faces pressure due to rising policy uncertainty and investor caution ahead of Chancellor Rachel Reeves’ budget announcement.

- Inflation Data in Focus: The UK Consumer Price Index (CPI) inflation data scheduled for Wednesday could impact GBP’s direction.

Technical Overview

- Moving Averages (Exponential)

- MA 10: 1.2933 | Positive Crossover | Bullish

- MA 20: 1.2860 | Positive Crossover | Bullish

- MA 50: 1.2719 | Positive Crossover | Bullish

- RSI: 62.24 | Buy Zone | Bullish

- Stochastic Oscillator: 75.70 | Buy Zone | Neutral

Resistance & Support Levels

- R1: 1.2691 | R2: 1.2801

- S1: 1.2335 | S2: 1.2225

Trade Suggestion:

- Limit Buy: 1.2815

- Take Profit: 1.3015

- Stop Loss: 1.2699

USD/JPY Struggles as Market Weighs Diverging Policy Outlooks

The Japanese Yen initially weakened but pared losses as investors assessed diverging policies between the Bank of Japan (BoJ) and the Federal Reserve (Fed).

Key Factors Influencing USD/JPY:

- Weaker Japanese PMI: The latest PMI data suggests slowing economic momentum in Japan.

- BoJ’s Tightening Policy: Expectations that the BoJ may continue raising interest rates support JPY.

- Fed’s Rate Outlook: The Fed’s plan for two rate cuts this year keeps USD bulls on the defensive.

Technical Overview

- Moving Averages (Exponential)

- MA 10: 148.95 | Positive Crossover | Bullish

- MA 20: 149.28 | Positive Crossover | Bullish

- MA 50: 150.91 | Negative Crossover | Bearish

- RSI: 48.91 | Neutral Zone

- Stochastic Oscillator: 68.29 | Neutral

Resistance & Support Levels

- R1: 154.47 | R2: 156.20

- S1: 148.88 | S2: 147.15

Trade Suggestion:

- Limit Sell: 149.75

- Take Profit: 148.55

- Stop Loss: 150.62

AUD/USD Rises on Strong Australian PMI Data

The Australian Dollar (AUD) strengthens as the latest Judo Bank PMI data exceeds expectations.

Key Factors Influencing AUD/USD:

- Australian PMI Data:

- Manufacturing PMI: 52.6 (Previous: 50.4)

- Services PMI: 51.2 (Previous: 50.8)

- Composite PMI: 51.3 (Previous: 50.6)

- RBA Policy Expectations: Analysts anticipate that the Reserve Bank of Australia (RBA) will keep rates steady.

- Market Sentiment: Revised US trade policies and potential Chinese stimulus measures support the AUD.

Technical Overview

- Moving Averages (Exponential)

- MA 10: 0.6309 | Negative Crossover | Bearish

- MA 20: 0.6307 | Negative Crossover | Bearish

- MA 50: 0.6307 | Negative Crossover | Bearish

- RSI: 47.64 | Neutral Zone

- Stochastic Oscillator: 42.40 | Neutral Zone

Resistance & Support Levels

- R1: 0.6356 | R2: 0.6431

- S1: 0.6111 | S2: 0.6035

Trade Suggestion:

- Limit Sell: 0.6322

- Take Profit: 0.6259

- Stop Loss: 0.6364

Elsewhere in the Forex Market

- USD/CAD down 0.11% to 1.4339

- USD/CHF down 0.07% to 0.8825

- EUR/GBP up 0.02% at 0.8374

- EUR/AUD up 0.01% at 1.7243

- AUD/NZD up 0.32% at 1.0975

- USD/CNY up 0.11% at 7.2565

- AUD/SEK down 0.21% at 6.3508

Key Economic Events & Data Releases Today

- (USD) S&P Global Manufacturing PMI (Mar) – Forecast 51.9, Previous 52.7 at 19:15

- (USD) S&P Global Services PMI (Mar) – Forecast 51.2, Previous 51.0 at 19:15